A rising tide lifts all boats indeed! Just 2 months back during my last portfolio review, it was still doom and gloom for our SREIT sector spiralling into a bottomless blackhole. Then suddenly, with the much anticipated rate cut by the US Feds finally materialising, all the SREITs counters started soaring. Considering that my REIT heavy overall portfolios makes up 66% of the entire investment, it contributed to a strong recovery. Coupled with the sudden China stimulus measures announced over the past few days, my China centric investments (Alibaba, Ping An, Link REIT and Capitaland China Trust) shot up by close to 25% which help rallied the overall gross investment value and investable cash balances to above the S$1 Million mark. Net investments after netting off margin loan stands at a record high of S$732K.

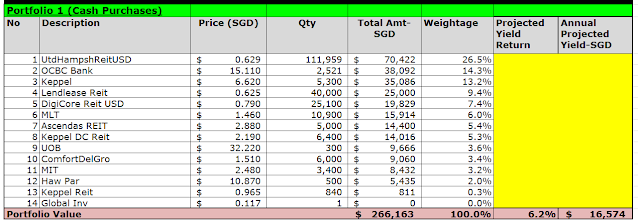

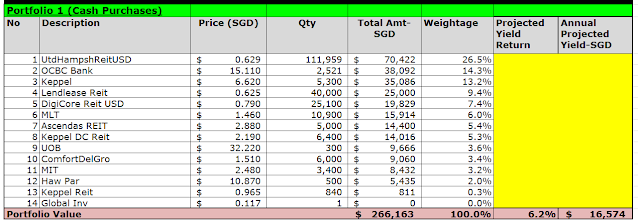

1. Portfolio 1- Stocks held in SGX Central Depository

(Note: This portfolio is designed to provide immediate dividends for use as it is under my own CDP account and the dividends credited goes directly to my bank account.)

2. Portfolio 2- Margin purchased securities

(Note: My margin purchased securities has grown to a sufficient scale to sustain itself and can pay off annual financing charges as well as to gradually pay down the margin loan through dividends generated.)

I think that the financing charges would have dropped to 4.75% or 5%- anyway, have not had the luxury of time to find out from my broker. So will just leave the financing rate at 5.25%. Interestingly, my wife offered to lend me funds at a lower by 1% rate to Maybank Securities but I rejected it as I told her that she can put her liquid funds to better use and a higher return.

For Keppel Pacific Oak REIT, I think that if interest rate continue to trend downwards, there will be a higher probability that the REIT Manager may resume distribution payout as soon as the 2nd half of 2025 instead of 2026.

3. Portfolio 3 (with Tiger Brokers and MooMoo)

(Venture into higher risk as well as capital growth stocks here)I have added on to Ping An Insurance just before the huge rally in HKSE. Keppel Corp as well as a small tiny stake in Oceanus were added since the last update 2 months ago.

4. Portfolio 4 (Endowus Unit Trusts & Other Investments)

The Income Insurance and Allianz takeover deal continued to be in limbo. The Monetary Authority of Singapore has not officially given the deal a go ahead. In addition, new capital were injected into the different Endowus units trusts (picked those that are bonds focused with the exception of Fidelity Global Dividend Fund).

Summary

While the investment value of my underlying portfolios have went up significantly, the sad fact is that my projected annual passive income still remain the same as 2 months back which is a tad disappointment. I do look forward to exiting my stakes in Alibaba once it hits over HKD160 per share and then convert them into higher yielding income producing assets.