Recently, I decided to take a closer look at the financials of Manulife US REIT as I was rather confused by some analysts asserting that Manulife US REIT has a dividend yield of 8% but when one check the SGX dividend announcements, the annualised dividend yield is only around 5.4%. Apparently, there is a "missing block of dividends". Upon closer examination, the missing block of dividends is actually the capital distribution component of the half yearly distribution. The next question would be why is Manulife US REIT paying out distribution from its capital? Most importantly, is the future distribution sustainable? Also, is there a fundamental deteroriation in the results of the REIT?

1. FY2020-Manulife US REIT Making Losses

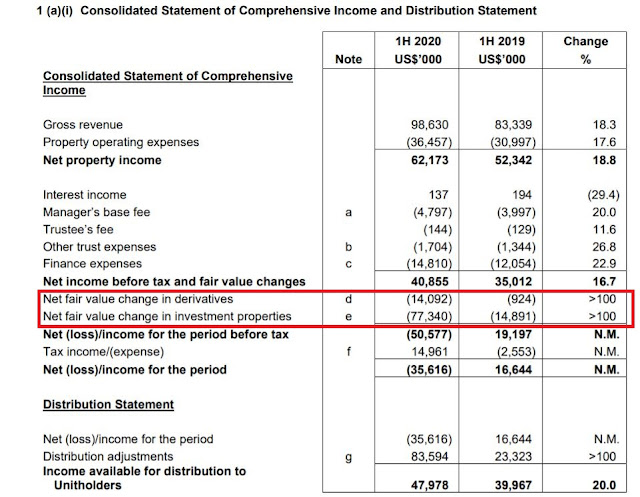

Yes. This is not a typo. Manulife US REIT results for the first half of 2020 is a loss making one and the entire FY2020 is also expected to be a loss. But why are so many analysts still painting Manulife US REIT as a resilient REIT during this COVID induced recession?

|

| Summary Income Statement |

If one is a long term investor, then this set of loss making results as at the first half of 2020 is not something to be too worried about. The main reason for the unrealised loss is due to the flamboyant fair valuation concept in accounting that creates the volatility. Basically, the investment properties fair value went down by <US$77Mil> during the economic crisis. Since the tenants are locked in for a long WALE and are of good quality, this fair valuation yoyo is not exactly a major concern. When the recovery comes over the next 2-3 years, the independent valuer will become more optimistic and relaxed their assumptions and one will find the fair valuation goes up again.

|

| Fair Valuation Losses From Derivatives and Investment Properties-US$92Mil |

Also, since our topic is on distribution sustainability, I would like to point out that fair valuation losses does not impact the cashflow.

2. Free Cashflow Analysis

|

| Free Cashflow Computation |

Based on extrapolation of the 1st half FY2020 results, the entire FY2020 is expected to deliver a free cashflow of US$74.6Mil. However, distribution payout is US$96.6Mil. There is thus an apparent over-distribution of <US$22Mil> which is not sustainable and is being financed via either bank borrowings or previous rights issue.

|

| Extract from 1H FY2020 Cashflow Statement Manulife US REIT |

As per the cashflow statement, note that US Manulife is actually borrowing to finance its capital expenditure and leasing costs. I am currently not a fan of the use of leverage as a tool to keep on financing the distribution to unitholders as it adds on to the interest cost and weakens the financial position of the REIT. A more sustainable payout would be to reduce it by around 23% which gives a dividend yield of 6.37%.

Parting Thoughts:

I have sent out an email to the management of Manulife US REIT to seek clarification on the rationale of using borrowings to finance additional distribution not just for FY2020 but also prior FY2019 (yes, the free cashflow is also negative in prior year). I reckon that the reply would be this is to take advantage of lower borrowing cost as there are still ample debt headroom to optimize the capital structure. However, this argument will be Deja Vu to me as I recalled the episode of Asian Pay TV Trust which delivered fantastic payout before the music stops and the price crash.

Anyway, Manulife US REIT does have a number of strengths such as having having grade A offices, diversified and good quality tenants with long WALE. Interestingly, Manulife US REIT had raised US$142Mil in FY2019 at a pricing of US$0.876 per unit. So, new investors who decided to be vested actually enjoy a free US$0.136 per unit contribution by previous unit-holders based on the last market trading price as at 8 Jan 2021.

Updated 16 Jan 2021: Please refer to this latest post on comments from Manulife US REIT Investor Relations.

Fair value change does not impact dpu as long as fundamental is not changed. One example is Accordia Golf trust impairment.

ReplyDeleteFCF is not a right way to look at reits. As it is structured differently. Need to look at the cash flow statement.

If u compare the reits like CICT. DPU is more than FCF pershare every single year.

Hi desmondsph,

DeleteGood day! Thanks for dropping by and leaving your comments.

1. I think we are aligned on the Fair Value concept. My article clearly stated that fair value changes do not have any impact on cashflow statement. Income statement and Cashflow statement are ultimately 2 very different creatures from accounting perspective. Think you missed the last paragraph of Section 1 which I will repost here: "Also, since our topic is on distribution sustainability, I would like to point out that fair valuation losses does not impact the cashflow."

2. I cannot think of a more appropriate and conservative way to look at sustainability without consideration of recurring capital expenditures which includes maintenance expenses such as as re-painting projects or roof replacements in order to maintain the buildings to ensure they are still rentable relative to new offices that comes onto the market. These are maintenance CAPEX.

3. However, if is enhancement CAPEX such as additional plot ratio built up, then I agree that this should be funded either through borrowings or equity as it can be recovered via substantial improved future earnings.

Let's do a theoretical example. Assume Manulife US REIT already reached 50% leverage limit. So, how is it going to keep funding its maintenance CAPEX such as repainting or waterproofing works? The only way is to reduce payout by 23% in such extreme scenario which will be sustainable in the long run. If FCF is out, may I enquire what is the method which you will recommend using? Operating cashflow only?