Singapore Medical Group (“SMG”) share prices has fallen by a whopping 44.1% from its peak of S$0.715 on 17 July 2017 to only S$0.400 as at 8 January 2019. This is despite Q3 2018 YTD revenue growth of 27.8% and net profit after tax growth of 66.7% relative to FY2017 Q3 YTD. What is even more astonishing is that the share price has languished albeit the explosive growth of revenue and net profit attributable to shareholders over the past 3 years.

Taking into account the previous rights issue at S$0.48 on 4 July 2018, investors who bought in at the current pricing of S$0.40 would have gained an immediate discount of 16.7% to the fair value of cash on hand where the bulk of the recent S$6.6Mil cash raised is still held in bank and only S$2.2Mil were utilized as at 31 Dec 2018.

Business Activities of SMG

SMG is a multi-disciplinary specialist and primary healthcare service provider. SMG had grown significantly year on year. The 3 main medical activities of SMC are (i) Healthcare (Obstetrics & Gynecology; Women’s Fertility; Dental; Oncology; Health screening), (ii) diagnostic imaging (fast-growing segment) and (iii) Aesthetics. It has also recently ventured into pediatric services and SMG has also been aggressively growing its footprint beyond Singapore to Malaysia, Indonesia, Vietnam and Australia in the region.

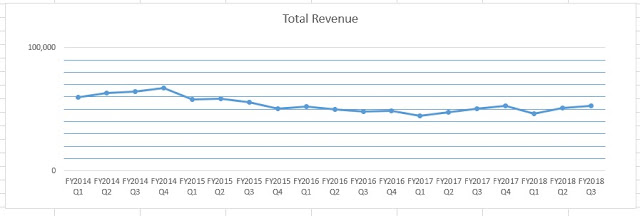

Financial Performance of SMG

The last 3 years of growth for SMG from FY2016 to FY2018 has been rather explosive since the change in senior management- please see below section on the management team led by Dr Beng Teck Liang.

For FY2017, SMG net profit jumped +250% from S$2.4Mil in FY2016 to S$8.5Mil in FY2017 on revenue of S$68Mil.

For Q3 FY2018 YTD, it has achieved profits of S$ 9.984Mil relative to S$5.988Mil which is an impressive 66.7% growth. This is on the back of growth of +27.8% in revenue from S$49.2Mil in Q3 FY2017 YTD to S$62.88Mil in Q3 FY2018 YTD.

I am anticipating good results announcement for Q4 FY2018 once SMG published their final results.

Valuation Assessment-Comparison of Current Financial Benchmark to Competitors

For the purpose of the benchmarking exercise, let’s use Raffles Medical Group and Q&M as a proxy. SMG is trading at around 14 times FY18 PE relative to other Healthcare Group of approximately 25 times FY18 PE. This is a steep discount in terms of valuation based on PE in the medical services industry.

Strong And Experienced Management Team Led by CEO Dr Beng Teck Liang and Chairman Tony Tan

When Dr Beng took up a 20% stake in SMG in June 2013, the group had been recording huge losses for close to 2 years. Dr Beng was instrumental in restructuring the business through cost-cutting measures, getting good doctors to stay on and re-negotiated contracts.

Technology had featured prominently in the transformation of SMC. Dr Beng who worked before as Managing Director for Hewlett-Packard (HP) Thailand and Chief Medical Officer at Novahealth, was the one who introduced electronic medical records digitalization, a web based, cloud based Radiology Information System (RIS) as well as Picture Archiving and Communication System (PACS) into SMC.

SMG announced the appointment of Tony Tan Choon Keat as non-executive chairman on 2 December 2013. Tony has vast experience in the healthcare industry. He was the founding managing director of Parkway Holdings. During his tenure at Parkway Holdings, he made acquisitions and development by Parkway Holdings both in Singapore and overseas to build up its healthcare franchise to one of the major healthcare players in Asia region.

Future Growth

SMG planned to upscale and expand their aesthetics services to Vietnam and Indonesia markets.

Things To Watch Out For When Investing In SMG

Most investors seem not to have noticed SMG. The daily volume being traded are still razor thin. One might not be able to easily liquidate for conversion into cash if required.

In addition, SMG currently does not pay out any dividends hence this may be another reason why many investors shun it. However, it has been announced on 3 July 2018 that the Company is seriously looking into a formal dividend policy in FY2019 along with a share buy-back mandate. The risk here is that this is just verbal talk and it does not materialize.

Also, the current M&A strategy also comes with high execution risk. There will also be more rights issue given that the management seems to be very aggressive in pursuing inorganic growth.

Last but not least, it is a fallacy to think that medical earnings are resilient. The adverse impact of dwindling medical tourism has been negatively affecting all medical players such as Raffles Medical Group as well as SMG.

Parting Thoughts

I think that SMG is well positioned for another year of good growth in FY2019. Based on its PE against its peers, a conservative estimate will be that there is at least a 50% upside potential in its share price. I am projecting a 20% increase in its share price performance annually in FY2019 and FY2020 respectively due to the splendid leadership of their Board of Directors which has delivered 3 years of solid financial results. I am sure the pro-expansion mindset of SMG Senior Management team through organic and inorganic growth will steer SMG forward and turn it into a premium regional healthcare provider.