The top news for the past week, which many SREITs investors are super excited about, seems to be the acquisition of the Genting Lane Data Centres by Keppel DC REIT (“KDC”) from its Sponsor Keppel Ltd. Many analysts and also postings on social media by bloggers & YouTubers have been singing high praises over the upcoming acquisition and the associated equity fund raising of over S$1 billion in capital. The private tranche has over 3.4 times of oversubscription and I believe that the upcoming preferential offerings for retail unit-holders will be also as hot and crazy. While I think that this deal is sensible, nevertheless, I thought that it is not exactly a fantastic one and there are some key risks here that some investors seemed to have closed one eye given the hype over Generative AI and the usual strange belief that KDC can grow its distribution per unit indefinitely with many more such "upcoming fantastic acquisitions".

Things are not exactly rosy at KDC

Well, I don’t want to be a wet blanket here. I mean I am also a former firm believer that the data centre leasing business has resilient demand with tenants that will not be migrating upon expiry due to the significant challenges in moving all the data servers and that the current Tech focused world means that this is the latest hot cake that will be growing exponentially to cater to the insatiable market demand-look at the mind whopping double digit rental reversion that the Data Centres are charging their tenants upon lease renewal-KDC announced during their half year results that they have renewed a major tenant for +40% rental reversion. The prospective new leases at Genting Lane Data Centres are also asserted to be up to 10% to 20% lower than the prevailing market rate which implied more potential upsides upon their current lease tenant contract expiry.

However, folks seemed to have forgotten about (i) KDC trouble at Guangdong DC and (ii) also that its current distribution to unit-holders are on artificial life support with S$13.2Mil none-recurring distribution from the DXC settlement that the management has cleverly spread over the 1st half and 2nd half of FY2024 respectively to avoid a significant tapering off in distributions to unit-holders. (iii) In addition, the new acquisition is not a free-hold building. The ownership is only for 15 years or 25 years if the extension option is being exercised and paid for. I call these the 3 key risks of holding on to KDC which I should elaborate on further:

(i) KDC trouble at Guangdong DC

I have not heard updates from any reports that the Guangdong DC losses have been plugged. I recalled vividly that Keppel DC is still unable to collect any rental income from this DC. This is extremely bad news. We need to be surgical here. The 1st half DPU from KDC is only 4.549 cents. Normalizing this, the projected DPU for FY2024 hovers around 9.098 cents or S$0.09098 per unit. Taking into account its current market price of S$2.220 as at 22 November 2024, this implied an absurdly low distribution yield of 4.1%.

(ii) There is S$13.2Mil of DXC settlement that has been spread over the 2 halfs of FY2024

What this means is that if not for this DXC non-recurring settlement fees, the DPU for KDC will drop even lower than the already rock bottom 4.1%. Even with the recent upcoming acquisition of the Genting Lane DC which proclaims to be DPU accretive of up to +8.1% , the new projected DPU will be at a yield of 4.43%. Bear in mind that we are no longer in a zero or extreme low interest rate environment anymore unlike the last decade.

Also, this deal is being structured such that only 49% of the control of the new data centres falls under phase 1 in December 2024 while the remaining 51% will only complete in 2nd half of FY2025 (next year) so the effect of the increase of the +8.1% will not be immediate. So, this means that the yield is unfortunately still not very attractive for myself. I am expecting a yield of at least 5.5% to 6% for holding on to KDC.

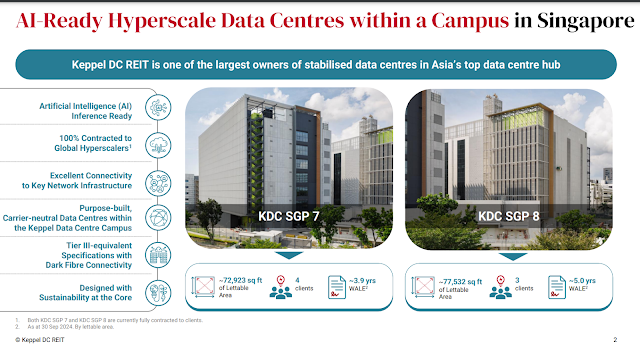

Given that this deal is valued at S$1.3 Billion, this will bring the Assets Under Management ("AUM") to S$5.2 Billion. 25% of AUM of KDC will thus be under the very short tenure of 25 years which is the norm for industrial property in Singapore. What this means is that the assets value will plunge to zero and unit-holders will need to be ready for another equity fund raising to extend the tenure from government agency JTC. This brings us back again to my point that 4.43% distribution yield is extremely low as unit-holders need to prepare to plough back capital into KDC at the end of 25 years. Keppel Infrastructure also have this issue with their concessionary assets under management but at least their dividend yield of approximately 7%-8% will cover part of the capital recycling cost to unit-holders.

Summary of Part 1 of 2

Note that above are just my personal thoughts guiding myself on whether I should be subscribing for this KDC preferential offerings. You folks may have a totally different and optimistic view and that is fine. So don’t roast me for this post.

In view of the above, I think I will only be subscribing to the bare minimum based on the allotment ratio and some extra to round up the numbers. I think that there is still a possibility that the market price of KDC may decline further.

Thanks for sharing your insights on KDC. Just curious, based on your observations on the apparent risks, why aren't u selling or reducing your KDC holdings while it is going up because of current positive sentiments and then buy back later when price of KDC decline because of the risks ?

ReplyDeleteHi Mate, I already sold off over 9,000 units of KDC at S$2.32 per unit on 29 Oct 2024. You can refer to my previous post here: https://dividendpassiveincome.blogspot.com/2024/11/keppel-ltd-heavily-leveraged-and-un.html

Deleteu sold off at peak of stochastics that is coming down coincide w a bearish divergence on macd.

ReplyDeletetimely click

so u

Hi Wai Chan, thanks for dropping by. You seemed to be well versed in technical analysis wor……awesome! :)

Delete