Today, the market reacted with shock at the sudden U-Turn in results announcement date of 31 Jan 2024 by Keppel Pacific Oak US REIT ("KPO REIT") and it crashed over <20%> as at 11.00am of 31 Jan 2024. Valuation report is out with a decline of 6.8% in property valuation, which I thought, is rather good news given that its aggregate leverage ratio is at 43.2% and Interest Coverage Ratio at 3.1 times as at 31 December 2023 year end.

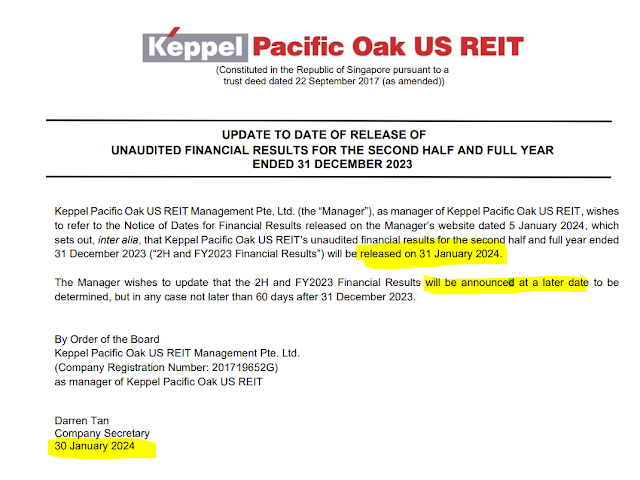

I am not exactly sure why KPO REIT management decided not to release the financial results as pre-planned in their notice on 5th January 2024. But this U-Turn move may signal some hidden can of worms such as adjustment of financial results or massive reduction in dividends to pay off debts.

|

| Extract of announcement on decline in valuation by KPO REIT |

I think should wait. Like you said, the delay might signal a can of worms. We dont have perfect information when investing but this move by them signaled material information that is coming to light. I prefer to make a decision after knowing what it is.

ReplyDeleteThere is a risk that the market had overreacted and is now at a level where it will correct itself back up but i rather miss the bottom then potentially buy a troubled stock that can potentially drop further.

Hi YX, think you are right. The market seems to have overreacted yesterday. When I check the high and lows of yesterday, seems that at one point it crashed by 25% from previous day and by end of trading, its losses retracted a bit and declined by 12.5%.

DeleteAgree with your thoughts fully on rather missing the bottom than jumping in rashly. I am also waiting for further news release....will keep my fingers crossed in the meantime.

https://www.theedgesingapore.com/capital/results/kore-suspend-distributions-announces-recapitalisation-plans

DeleteDistribution suspended. Lucky never go in.

Hi Blade Knight, I've been looking into this and I can't really think of a reason why they would need to cut their dividend significantly. Gearing moving up to 43.2% and ICR moving from 3.3x to 3.1x tells me that other assets and debt haven't moved too much from before.

ReplyDeleteFrom what we know so far, it seems like the only thing they're potentially low on is cash-on-hand, and they have more debt headroom to come up with additional cash if they need it. If that isn't an option, or not the ideal option for them, perhaps they're in the process of selling an asset and are waiting on that to close before disclosing results?

I have 2 fears at this point:

#1 is that a major tenant has decided to vacate (or simply stop paying) between YE 2023 and now. This would hopefully generate cash from termination fee, but if there aren't any fees to collect, they could add a provision for expected credit losses in the distribution adjustments. They could also decide to decrease the distribution from 100% to 90% of taxable income if they choose. But both of these wouldn't decrease the distributable income by too much though right? I think it's fair to assume another DPU cut since they've decreased it over the last 3 consecutive halves.

#2 is that although they said they weren't breaching any lender covenants here, it's possible they've triggered a lender covenant for one reason or another since their previous notice, and are now in default - which is what triggered the whole mess with Manulife.

Can you think of any other reasons that they would choose to delay results?

P.s. By the way, I think the 6.8% loss in valuation is a huge win for them compared to what we were expecting based on cap rate expansion and performance declines in the US. This certainly opens up more flexibility into what they can do over the next year.

Also, please correct me if I'm wrong, but I was under the impression that S-REITs aren't able to reduce distributable income to pay off debts?

DeleteI thought they could only pay off debts with cash (after distributions), or under circumstances such as Manulife where they could elect to halt distributions altogether and would cause them to lose their tax-advantaged status with MAS.

Hi Austin, sorry for my late reply. Debts can be paid by not distributing dividends. As at 15 Feb 2024, this is exactly what Keppel Pacific Oak has done by electing to stop distributions totally for 2 years.

DeleteDownside is that they will most likely end up with higher tax expenses since they are no longer a REIT under definition to qualify for exemption until they start paying distributions. I also do not think that Uncle Sam will grant them any special tax waiver for not complying with the necessary REIT structure and requirement even if they write in.

Thanks for the reply! Yes it looks like I was wrong, but good thing for the long-term. They were heading towards a cash crunch with the $75mm debt maturing this year and ~$50mm Capex needed.

DeleteI was surprised to hear that their debt headroom only extends to 45% gearing, and unlike Manulife, Lender covenants limit them to 50% gearing before default.

But I still do not understand the tax consequences of losing REIT status. From the notification, it looks like impact is minimal as long as W-8's are submitted.

Looking at Manulife's H2 vs. H1 financials, it appears the effect of halting distributions increased withholding tax by $700k to $1.2mm, which seems insignificant compared to their $36mm taxable income in H2.

Is there something I'm missing? i.e. "Potential" additional effects that are possible, effects we won't see until H1 '24 financials, or other tax consequences to the investor?

Also, do these tax withholdings actually impact cash position? How and when does that happen? Manulife's financials suggest they paid only $2,000 in cash for taxes in H2. Should we be expecting a huge number in H1 2024?

Thanks again for your help on this!

- Austin