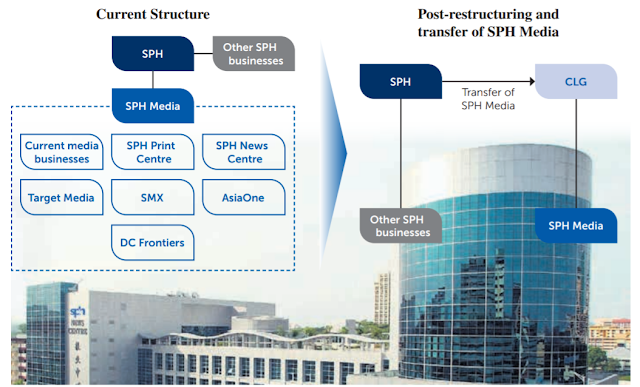

I thought that it is a no-brainer to agree to the transfer of Media business out of SPH and into the newly created CLG entity. Media is a loss making business. Existing shareholders need to bite the bullet and agree to pay the divorce fees to get rid of the Media segment. It is only with the media business out of SPH that we can move on to the next stage of a wider corporate action options being made available to sell of the property business of SPH to other interested 3rd parties.

1. Media still making losses despite 2 rounds of staff cutting to save reduce labour cost.

Once the traditional media economic moat is being disrupted by Facebook, google etc, there is no point in trying to keep doing "headcount restructuring". SPH already went through 2 rounds. There is a limit that can be cut in order to preserve the quality of journalism and news being reported.

2. Naive to think that there is a chance to sell of Media segment to external overseas parties

While I seen on investment forum some shareholders who held on from S$4 per share many years back to the current disappointing S$1.92 per share lamenting that they are against the spin off of Media and hope to sell it to other parties, I think that they are not being rational and just being naive. The Singapore Government will never allow a media company to be controlled by 3rd parties or foreign MNCs. No sane government will allow that.

3. Retail investors must play their own part to exercise their EGM rights.

This is a common issue with retail investors. Many do not take part in shareholders' activism to protect their own rights and interests. How many times has a retail investor take part in AGM or EGM? How many bother to fill up the proxy form to appoint the chairman to vote on their behalf even if they do not have time to attend the AGM/EGM? The common reason given by individuals here is that our shareholdings are too small relative to the big boys (institutions).

If everyone thinks like that, then it is confirmed gone case. Look at Sabana REIT, their minority retail investors work hand in hand with some of the other shareholders to prevent the acceptance of a low ball offer. Hence rather than complaining, it is still better to take action. Your 0.001% vote may be the difference to get a normal resolution pass the 50% mark or the more than 75% mark for special resolution.

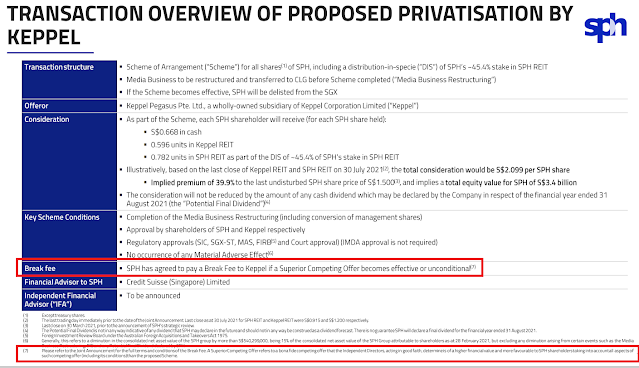

Note that the last date and time for lodgment of the proxy form is on 7th September 2021.Note that Resolution 2 will also need to be passed through for SPH to adopt a new constitution without the provision of the Newspaper Act in order to be eligible for the Keppel Corp buyout offer.

Final thoughts:

For shareholders holding their shares through custodian brokerage accounts, please do approach your brokerages on how to contact their admin department to help you submit your vote for the SPH EGM. Personally, I thought that the deal to transfer out the Media business will definitely go through as it just requires a more than 50% vote on 10 September 2021. However, the risk is in the 2nd resolution to overhaul the original constitution to take out the "Newspaper Act" which requires more than 75% votes. Once both resolutions go through, I reckon SPH share price will go up a bit more due the boost in certainty of being eligible for the Keppel Corp buyout.