Like clockwork, the management team of United Hampshire US REIT (“UHREIT”) delivered another set of splendid 2nd half and full year 2023 results. It’s the only US Commercial REIT to deliver improved market valuation of its investment properties relative to the disastrous drop in valuation of the US office REITs due to higher capitalization rate and discount rate from higher interest rate. Its overall aggregate leverage ratio improved slightly to 41.7% relative to FY2022 of 41.8%. Unfortunately, UHREIT seems to have been impacted by the recent crash in US office REITs market prices. Its unit price has declined -10% from its peak price of US$0.52 per unit attained earlier during the 1st week of February 2024.

1. Quick Results Highlight

Gross revenue grew +7.1% to US$72.2Mil relative to US$67.6Mil in FY2022 while Net Property Income increased by +7.6% to US$50.6Mil relative to US$47.1Mil for FY2022. However, distributable income declined from US$33.1Mil to US$30.4Mil (-3.6% drop) in FY2023 mainly due to (i) higher interest expense and (ii) the paid out of 2H 2023 Management base fee in cash to preserve unit-holder value and minimise unit base dilution.

The 63,000sqft of new Academy sports + Outdoors store at St. Lucie West commenced operations in November 2023 which was way ahead of original schedule in 2024. Its opening was just in time for the year end festive shopping season and was a contributor to the growth in gross revenue.

2. Capital Management

Aggregate leverage is at a healthy 41.7% due to spike in valuation of its investment properties. There are also no refinancing requirements until November 2026. While UHREIT is also under the general category of commercial property REIT, it is way different from US office REITs.

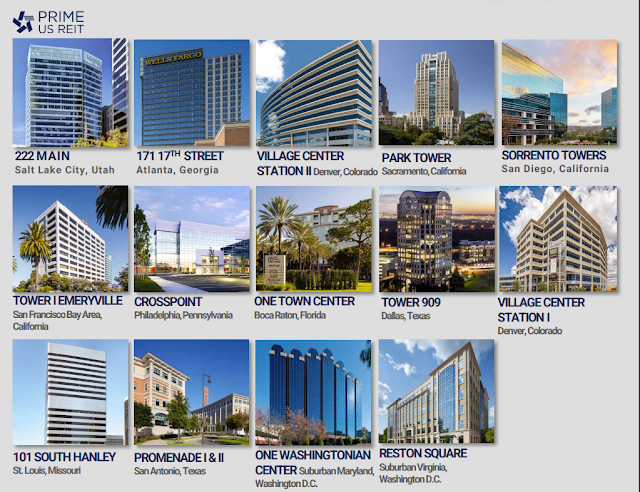

As we can see above, office commercial property valuation has declined by <-32%> since June 2020 while Strip Center commercial property valuation (such as those owned by UHREIT) increased by +14% since June 2020. We know the tragic fate that had befallen Manulife US REIT, Prime US REIT and Keppel Pacific Oak US REIT all of which are struggling from or close to breach of aggregate leverage ratio due to the drastic decline in property valuation. UHREIT currently possesses the most resilient class of commercial properties that have survived the COVID crisis as well as the current high interest rate environment crisis resulting from inflationary control measures.

3. Admirable High Distribution Yield from UHREIT.

At 5.54 cents and US$0.445 market price per unit as at 24 February 2024, UHREIT is giving out an annualised 12.45% distribution yield.

If we stripped out the amount reserved for further AEI or capital expenditure as well as management fee in cash, UHREIT is still giving out an impressive distribution of 4.79 cents and an awe-inspiring yield of 10.76%.

Parting Thoughts

UHREIT has been delivering a consistent and splendid results yearly since its IPO. So far, it has proven itself to be exceptional well run and resilient despite the COVID crisis and escalating interest rate plight faced by its business operations. Keeping my fingers crossed that it continued to perform well and that its investors gradually realise the value proposition its business and that they sky high risk premium demanded from UHREIT will decline over time.