Who dares win.....create your own passive income and achieve financial independence. Be in control of your own destiny.

Wednesday, 28 June 2023

Family Portfolio Management Update-27 June 2023

Monday, 26 June 2023

Endowus Cash Smart- Higher Yields From Net 3.7% to 4.9% Relative To Saving Accounts But Beware That Not Capital Guaranteed.

Saturday, 24 June 2023

Stock Markets Down Again Due To Hawkish Stance of US Federal Reserve Chair- But What Does One Expect?

Thursday, 22 June 2023

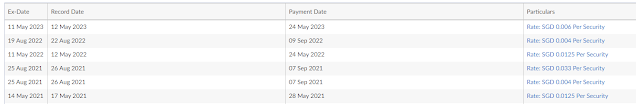

United Hampshire US REIT Disastrous Market Price Performance.

While all US REITS listed on SGX seems to be doing badly in terms of market pricing performance, UHREIT is unique in that it is neither (i) facing secular demand headwinds like the US commercial office REITs with high vacancy rate due to "work from home" culture nor (ii) having exposure to major tenant default akin to US DigiCore REIT. While soaring financing cost due to the current elevated interest rate environment does weight on its financial performance, its unit price have been severely punished by the market albeit resilient operational performance for the past few quarters.

Wednesday, 21 June 2023

Give up on DBS DigiPortfolio- Lack of Transparency and Long Lead Time For Processing Transactions.

2. High Annual Management Fees Relative to Endowus and Syfe.

|

| 0.75% Management Fees- higher than Endowus and Syfe |

AIMS APAC REIT Preferential Offerings Ending 22 June 2023 (Thursday 5.30pm).

Saturday, 10 June 2023

DigiCore REIT Share Price Surprisingly Sharp Rebound After Announcement of Major Tenant Bankruptcy.

Monday, 5 June 2023

Personal Updates: Health Crisis and Medical Emergency.

(ii) After seeing that there is no improvement, I made a call to the polyclinic for an urgent appointment to see the doctor. Reason being that I was told my relatives that referral by polyclinic to specialist is the only way to get government medical subsidy for costly medical tests and treatment in event that it turned out to be dread disease. The polyclinic doctor does not think there is anything serious but wrote a referral for urgent colonoscopy to be done at public hospital.

(iii) Despite “urgent” referral, my appointment for further examination only took place 6 months later. 3months wait for an appointment to see the government specialist at hospital and another 3 months wait to get a slot for colonoscopy. I tried to ask for earlier appointment in view of severe diarrhoea that persist after medication but was told that there are no available slots.

(iv) After finally doing the scope 6 months later and doing a biopsy on some polyps, doctors did not detect any serious abnormality. I was just wondering had it really been serious, I may have already died waiting for 6 months just to do a scope. Our public healthcare is quite scary. The next time I think I better opt for private specialist route and just have to bite the bullet to pay astronomical medical fees.

|

| This is the cheap TCM supplment that saved me from non-stop diarrhoea and colon issues-a simple formula of Red Date, Perilla, Licorice Root, Ginger, Alfalfa Powder, Papaya |

(ii) I used to visit a respiratory specialist at Orchard Road area whenever the General Practitioner is unable to resolve my respiratory illness but to my horror, the expert doctor whom I consulted (whenever I am at my wit’s end), had passed away due to old age- he was 80 years old plus.

(iii) Left with limited choice, I went to Mount Elizabeth Hospital for urgent treatment since the junior doctor at neighbourhood clinic had no idea what to do and I feel like my lungs are drowning. I was fortunate to have found a good respiratory specialist there. The specialist said that he suspected that I have pneumonia after listening with his stethoscope and immediately sent me for X-ray (the amazing thing about private healthcare is that taking the X-Ray and waiting for results took less than 30 mins).

(iv) Turns out that I was having a nasty bout of bronchitis and the specialist immediately prescribed me the right kind of antibiotics to resolve the infection as well as a new type of inhaler for the asthma. Interestingly, one does not need to be displaying symptoms of fever if you have serious chest infection. Had I continued to visit the GP clinic near my home for treatment or wait for further referral to public healthcare specialist, I would probably have ended up being hospitalized or even dead due to their incompetence.

(v) However, I must say that private healthcare is damn expensive. Every follow up visit for treatment is around S$500 every 1-2 months.

|

| While viral infection does not need anti-biotics, it can lead to subsequent bacteria infection- this seems to confuse some inexperienced doctors at neighborhood clinics who adamantly refuse to prescribe anti-biotics and just treat a patient for only asthma |

(a) I see that recently, there are some discussions on lowering one’s monthly expenses for attaining early financial independence. My thoughts are that it is not exactly that easy given that as one advanced in age, many chronic illness or dread disease will follow. This needs to be taken into consideration in one’s financial planning and early retirement plan when it comes to decision making time on resigning from one’s job (before the official retirement age) and to draw down on one’s passive income or capital built up.