Who dares win.....create your own passive income and achieve financial independence. Be in control of your own destiny.

Friday, 31 March 2023

Alibaba Ripe For Harvesting By End of 2023?

Sunday, 26 March 2023

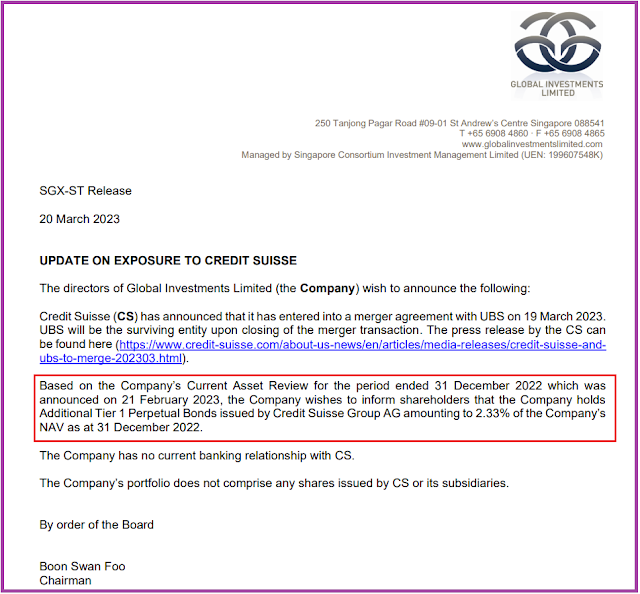

SGX listed Global investment Limited Loss Of S$6.08Mil Due to Investments in Credit Suisse CoCos.

|

| SGX announcement by GIL |

|

| Source: https://www.credit-suisse.com/about-us-news/en/articles/media-releases/credit-suisse-and-ubs-to-merge-202303.html |

|

| Total Revenue from main investments of GIL |

|

| Another 10% potential exposure in CoCos coming up from Germany bank in trouble |

Wednesday, 22 March 2023

DigiCore REIT Potential 2nd Major Tenant Potential Bankruptcy Crisis Temporary Postponed to April 2024.

Basically, on 16 March 2023, Cyxtera has announced that it has entered into an agreement with its lender to extend the maturity date of its 2023 debt maturity to April 2024 and has not requested DCR for any rent deferments, rental reductions or contraction of the space it occupies.

From my perusal, the 3 main points raised by Prof Mak in his article are as follows:

Monday, 20 March 2023

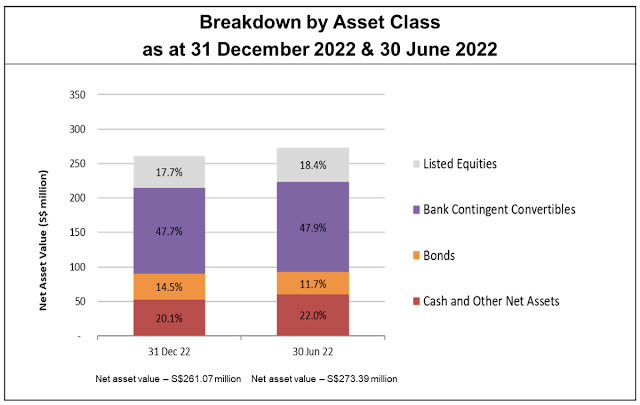

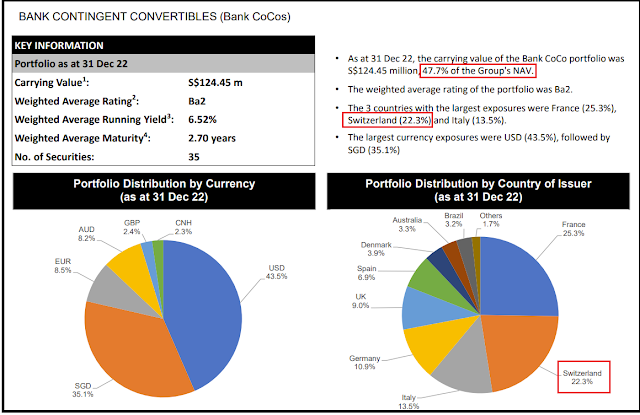

Global Investment Limited In Crisis Mode- 48% of Its Net Assets Are In Bank Contingent Convertibles (CoCos).

Given the cracks appearing in the international banking systems, holders of Bank Contingent Convertibles (CoCos) are now being exposed to an all time high risk. CoCos are the lowest rung of bank debt created during the European debt crisis to buffer banking capital. CoCo bonds is structured around a loss absorption mechanism, so it is a product with extremely high risk. When the regulatory authority makes a judgement that a bank is unable to continue its operation, it will reach the trigger point. This will force the conversion of CoCo bonds into ordinary shares or writing down of the principal of the bonds in accordance with the terms of its loss absorption mechanism. Holders of CoCo bonds might need to bear part of the loss or a total loss of their investment.

Saturday, 18 March 2023

DigiCore REIT- Disaster In The Making Or Potential Upsides?

Thursday, 16 March 2023

DigiCore REIT Sudden Plunge of Over 13% In A Single Day- Should Retail Investors Be Worried And Run For The Exit?

Wednesday, 15 March 2023

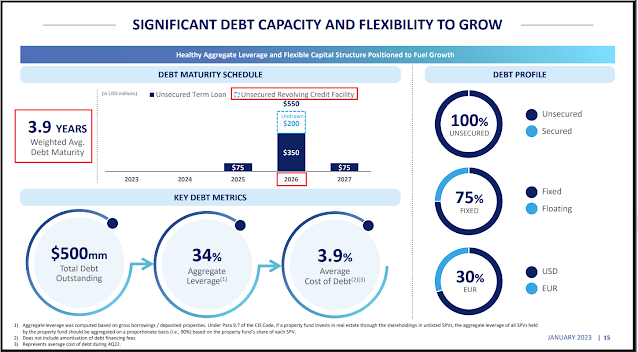

Manulife US REIT High Gearing Ratio Crisis To Be Averted With Entry of New Sponsor- Korean Mirae Asset Global Investments.

It sure looks to me that the original sponsor, The Manufacturers Life Insurance Company (Manulife), is bailing out itself. It did not offer any plan to buy-over any office asset of MUST to avert the potential statutory leverage ratio breach. This seems to suggest that MUST management has great reservations about the future income generating abilities of commercial office assets given the hybrid working arrangements taking root in US.

Sunday, 12 March 2023

US Financial System Maybe On Brink of Collapse- Run On Bank Contagion Risk.

To put it simply, SVB has been screwed badly by the relentless interest rate hikes that eventually caused irreparable losses to its balance sheet and a run on bank calamity.

Monday, 6 March 2023

Investment Portfolios Updates- S$565K (3 March'23)- Inflation Running Away Again.

Friday, 3 March 2023

First Quarter 2023 Dividend of S$23.8K and Personal Updates.

With the announcement of 2022 results by the last major REIT (United Hampshire US REIT) in my investment portfolio, the total expected dividends for this quarter will be S$23.8K. Given that most of my stock holdings gave out dividends only twice per annum as well as netting off interest expense cost for the margin portfolio maintenance, I think net passive income from my investment this year should approach S$50K which is approximately S$4K per month. This unfortunately is still not enough for me to coast financial independence given the dire mid-life career crisis that I am currently facing at workplace which I should share in my personal updates below:

Major changes occurred in my workplace towards the 2nd half of last year (2022). Those who have read "About Me" will know that I am an Accountant by profession.

1. My entire Singapore sales team got retrenched by our Corporate Office back at HQ due to poor performance and the Group CEO decided that we should just concentrate on running daily operations to keep existing clients happy and there is no need to do sales. Sales will be referred in by my Headoffice and overseas office.

2. Our General Manager of Operations was also asked to retire and given a golden handshake of 6 figures- very cool right...how I wish I was the recipient party and the boss would give me that 6 figures goodbye package.

3. Another strange development was that my local Director and Head of Singapore Business was offered a 50% cut to his monthly salary and allowances by HQ. Of course, my local director is not stupid (in fact one of the smartest and most intellectual bosses I ever worked for) and he fought back vigorously to defend his position. Since there was disagreement over the remuneration package, the headoffice exercised their rights to terminate the senior management contract and hence this is not a retrenchment with severance package. I am glad that my local Director is a good negotiator and he managed to fight for a few months of ex-gratia payments for his past contributions.

In a strange twist of fate, my Group CFO told me that he has discussed with our Group CEO and there will be no replacement for the Director of Singapore Business. He also asked me to step up to lead the Singapore business and this is something that the CFO said should not be an issue as I have been with the group for over 10-11 years. I was to take on a General Manager role while retaining all my duties as Head of Finance with a 20% pay rise. So now commercially, everyone is also looking for me for commercial decision making and accountability. Statutory wise, I am also forced to be nominated as a nominee director for the Singapore entity as Singapore law requires a local resident staying here. There were many "congratulations" sent out from various local and overseas senior personnel to me. By the way, I am not trying to "show off" here- this is actually not a career progress or good fortune but rather more of a punishment meted out to me which I should further elaborate below.

As alluded to the above, in case you folks think that this is a wonderful career progression, my workload suddenly increased 100% to 200% at the beginning of the new year and I am super stressed out as I am also expected to do entertaining of overseas visitors to our Singapore office to build up relationships.

Dasin Retail Trust Applied to SGX For Extension Of FY2022 Financial Release- Going Concern Issue Unresolved.

|

| Extract of 1st March 2023 Announcement |