Talking about when the rubber meets the road from my last post and all hell broke loose indeed. Lendlease Global Commercial REIT ("LREIT") announced on 22 March 2022 the impending kick off of the private placement as well the preferential rights issue of 29 units for every 100 units owned and wow, this is more than double the amount I was expecting. As I read on the fund raising document, I nearly fainted when they revealed the price of the rights issue to be at a whopping 9.6% discount to the weighted average market price- a low ball offer of S$0.72 per unit. Unit-holders who have no money or refuse to subscribe will be severely diluted by the super low ball price of S$0.72 per unit which is a 20% discount to the January 2022 peak of S$0.90 per unit.

I also expect the market price of LREIT to drop further upon the resumption of trade. Preferential unit-holders need to be aware of the dire predicament that they are in and to come out of the gate storming once the preferential rights issue commenced on 4th April 2022-which is a mere short 2 weeks to raise funds. Also, there is no escape, folks who tried to evade the rights issue by selling most likely will be facing further decline in the already low price once trading resumes; and those who purchase LREIT recently and refused to subscribe will face heavy dilution in their holdings. LREIT management has screwed everyone by the low price of S$0.72 per unit on top of demanding 29 units subscription for every 100 units owned.

Other key points to note:

1. Those who have lost their ATM card or forgot their ATM password please ensure you go to your bank to rectify the issue before the kick off of the preferential tranche.

2. For those who received from your stock brokers the invitation to participate in the private placement, note that you will not be eligible to participate in the Preferential Offerings if you decided to take part in it to get more units. The most discount for this exercise for the new units will be from the Preferential tranche of S$0.72 per unit whereas the Private Placement tranche will be priced between S$0.725 and S$0.740.

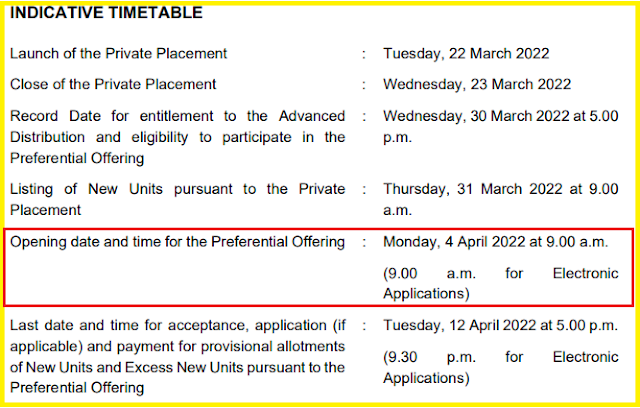

3. Opening date of the Preferential Offering is on 4th April 2022 (Monday 9am) and ends on 12th April 2022 (Tuesday 5pm).

4. For those who bought units under nominee brokerage accounts instead of your own CDP, please call up your brokers immediately if you do not receive any e-notification or physical letters to subscribe for the rights issue.

Will market price of LREIT drop below S$0.720 per unit?

Well, you never know. If the Russo-Ukraine war suddenly became a World War 3 with US and its European allies dragged in, then this is definitely a possibility but personally, I think such events will be remote for now.

Parting thoughts

For long term investors, I think that LREIT offers an attractive dividend yield of over 6.2% and possibility close to 7% forward yield based on the current low ball offer. The recurring tax savings of S$5.6Mil from Jurong East Mall (JEM) being restructured into a REIT and also the redevelopment of the 48,200 sqft car park near 313@somerset into a new multi-functional event space do also provide further potential upsides in the short to mid-term. On a longer term basis, there is the potential yield accretive acquisition in the pipeline of Paya Lebar Quarter (PLQ).