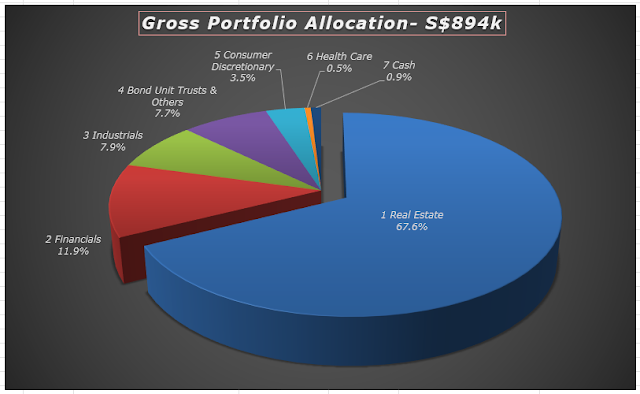

These past 2 months have been absolutely horrendous for investors that held SREITs in high concentration in their investment portfolios. It is like putting money into a blackhole where it just kept pulverising. The only good thing is that I have diverted most of my new funds, as well as dividends received recently, into the bond funds on Endowus platform. Lots of further work in progress to diversify the portfolios further from real estate related investments.

1. Portfolio 1- Stocks held in SGX Central Depository

(Note: This portfolio is designed to provide immediate dividends for use as it is under my own CDP account and the dividends credited goes directly to my bank account.)

2. Portfolio 2- Margin purchased securities

(Note: My margin purchased securities has grown to a sufficient scale to sustain itself and can pay off annual financing charges as well as to gradually pay down the margin loan through dividends generated.)

The valuation of SREITs in my margin portfolio continued to nose-dive. Dividends from stocks were used to pay off margin loan financing as well as foraging into the HKEX in the form of Ping An and Link REIT after seeing signs of recovery in the China and Hong Kong market.

3. Portfolio 3 (with Tiger Brokers and MooMoo)

(Venture into higher risk as well as capital growth stocks here)

I opened up another online trading account MooMoo here to further diversify the online brokers and also the lower commission on offer by MooMoo. MooMoo is also giving away more than S$280 worth of US shares for signing up. Have took up additional stakes in Alibaba as well as Ping An Insurance.

4. Portfolio 4 (Endowus Unit Trusts & Other Investments)

I have continued re-investing dividends from my Portfolio 1 mainly into the bond funds on Endowus platform. The market value for Endowus bond fund approximates the historical cost (with the exception of Income Insurance share price) hence I did not make any further fair value adjustments. From various sources that were using Philip Securities, privately held Income Insurance seems to be trading privately from S$20 to $22 per share on the blockchain powered Alta digital exchange platform. Logically, I think I should be selling it off if it is really at more than 100% capital gain and then reinvesting the proceeds. Nevertheless, since the amount I am holding is just a small stake, I think I will just keep it as a form of souvenir.