Great news! Manulife US REIT ("MUST") just announced on 25th Nov 2022 (Friday) that Citigroup Global Market Singapore has been appointed as its financial advisor to conduct the much anticipated strategic review of its business. Please also refer to my previous post: "Is Manulife US REIT A Good Buy at over 14% Distribution Yield Or A Dividend Trap?". I am pleasantly surprised that the CEO of MUST's Manager, Mr Tripp Gantt, took such rapid action coming off the 2nd Nov 2022 announcement that MUST will be launching self-introspection on its mandate as an only office REIT. Based on the current unit price, MUST is giving out a high distribution yield of around 13%-14%. I will further elaborate on 3 major implications of this upcoming strategic review exercise as well as touch on the possibility of the worst case scenario (as well as other possibilities) that will leave existing unitholders in a lurch.

|

| MUST unit prices has been pulverised by almost 50% over the past 12mths due to weak structural demand issues post COVID lockdown & rising interest rates |

1. Signs that the drop in US physical office demand maybe perpetual in nature hence the strategic review.

The extremely low physical occupancy rate actually indicate that demand may never return to pre-COVID levels. Currently 33.33% to 50% in different states are back to office. The only question now is how much is the magnitude of this permanent drop.

2. What other sector for its new business to venture into given the expertise among current management team?

Will MUST acquire warehouses or industrial buildings like Frasers Logistics & Commercial Trust ("FLCT") ? Or will it be venturing into Data Centres? If so, does its senior management team have the right expertise and proficiency given they have been managing only office buildings ? This bold move thus embolden certain business risk.

3. Even if the REIT ventured into other sectors, how would it finance and execute this transformation?

Now, this is the million dollar question. Will MUST start to sell off some of its freehold office buildings and then switch to acquiring new properties in other sector? Or will it spell a rights issue at the current pathetic unit price of US$0.385 and dilute all existing unitholders?

4. What are the other types of possibilities from this Strategic Review?

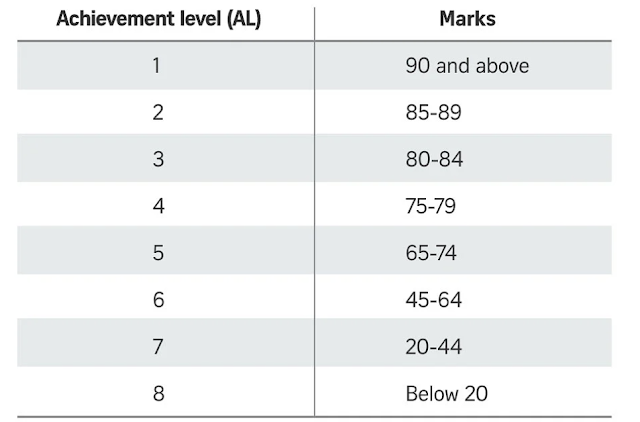

Due to the drastic sell-down, MUST unit price of US$0.385 as at 25 Nov 2022 is at a ridiculously low level compared to its net asset value of US$0.70 per unit as at 30 June 2022 (Mid year financial announcement). Besides the option of change in mandate to diversify into other sectors, there can also be 2 other options/scenarios:

4.1- Sell off some office buildings to realise its fair value of US$0.70

MUST can simply choose to sell off some of its freehold office buildings to realise its fair value. Since this is not a fire-sales, MUST will be in a strong position to negotiate with prospective buyers on a package deal. This has the potential to unlock value up to 82% with such realised sales. This can then be distributed out to unit-holders as a return of capital and an immediate catalyst to support the ridiculously current low unit price.

4.2- Buyout existing unit-holders at 20%-30% premium to current market price with investment firms and privatise immediately and subsequently seek to re-list at US$0.70 in another 2-3 years with some changes to assets mix.

Now, MUST can play punk and use a notorious method to take advantage of the current low unit price by offering a 20%-30% premium price to unit holders (by working with a few well-heeled partners) for them to privatize the REIT. They could offer US$0.462 per unit to US$0.501 per unit to rally enough support from existing disgruntled investors waiting for a quick bailout.

After fine-tuning the properties mix with some add on, they can relist the REIT publicly at its fair value to earn big bucks for its partners. However, many unit-holders will most probably be cursing and swearing at MUST management for short-changing them as many would have invested when price were hovering between US$0.70 to US$1.00 range 2-3 years back.

Parting thoughts

Personally, I thought that the conclusion of the strategic review would most likely lead to a huge rally in unit price of the currently badly battered MUST. The former Singapore Press Holdings share price is a good example of the eventual sharp rebound from its strategic review exercise. I have invested another 18,000 units of MUST (@US$0.385) per unit over the past week upon the appointment of the financial advisor.

(Note: There is no guarantee that MUST will implement any of the options identified through the strategic review. Also, MUST management reminded unitholders to exercise caution when dealing in the units of Manulife US REIT and to refrain from taking any action in respect of their investments which may be prejudicial to their interests. In the event unitholders wish to deal in the units of Manulife US REIT, they are advised to seek their own professional advice and consult with their stockbrokers, bank managers, solicitors, accountants and other professional advisers if they are in doubt as to the actions they should take.)