The stock markets tanked recently due to the Omicron variant. I have sold off 42,000 units of my SPH REITs under my Portfolios to raise cash level at the start of the week. Subsequently, prices of local bank stocks and REITs dropped further and I took the opportunity to buy into more OCBC and Mapletree Industrial Trust while retaining some cash. My investment approach is still primarily an income focused strategy using cash account (Portfolio 1) supplemented by my Portfolio 2 opened with Maybank Kim Eng and leveraging on their Margin facilities-current projected dividend income is +S$44.6K per annum. For me, no point in timing the market by selling a major part of the portfolio as it is better to stay invested in order to continue to receive dividends and not missed out on opportunities such as new M&A announcements.

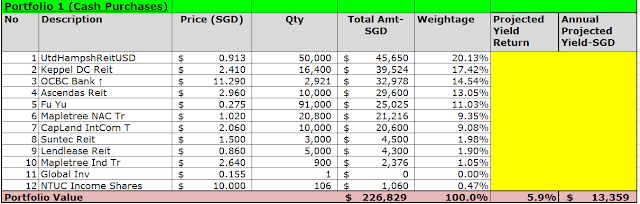

1. Portfolio 1- Stocks held in SGX Central Depository

Not much action here except for selling off of SPH REITs to buy into 1,000 OCBC shares while retaining cash of around S$10K here from the sales.

2. Portfolio 2- Margin purchased securities

(i) The past 2 months has been rather interesting. I took a calculated risk with my margin account by buying into SPH shares after the announcement of Keppel Corp proposed acquisition at S$2.01, figuring that the market pricing then at around S$1.90-S$1.93 range, offers the most probable upsides with S$2K in profits expected with the successful completion of the offer. Next, Cuscaden Peak came into the picture to start the bidding war and I closed off my margin position in SPH shares recently to walk away with +S$6K profits (S$2.34 per share exit) as I do not think there will be another 3rd party offer.

(ii) I have reduced my holdings in retails REITs such as Lendlease REIT and SPH REIT. Anti-COVID measures will hit retail badly if the Omicron strain spreads widely.

(iii) I have also increased my holdings in Mapletree Industrial Trust. I figured that it is prudent risk management to have the backing of strong sponsor like Temasek in the event that the COVID crisis worsen and there is a need for sponsor's cash injection should the property value plummet like in 2008.

3. Portfolio 3 (with Tiger Brokers)- Venture into higher risk as well as capital growth stocks here

However, my venture into China Alibaba continues spiraling downward non-stop with concern over forced delisting by China regulator from NYSE and I am taking a huge hit of unrealised loss of almost <S$9k> from it. I will probably do a short write-up on Alibaba in my next post.

Basically, I think the fundamentals of Alibaba are still intact despite the crackdowns by China regulatory and the lower growth rate. Just this week, I have invested another 100 shares of Alibaba at a price of HKD121.6 per share. But I think this is the last batch of Alibaba shares that I am buying to mitigate the risk of holding excessive Alibaba stocks.

Parting thoughts

I am looking forward to receiving further dividends in December 2021 for further re-investments. Let's see how the market reacts next week and whether there is further blood-bath due to the Omicron variant. However, personally, I do not think Omicron will be a repeat of the 2020 March crash as current vaccine surely still must have some effects (despite reduced efficacy) on the new COVID strain and chances of world-wide lockdown again is slim. I will continue buying in piecemeal to exploit the current market decline.