The recent SREIT rally has finally put a brake on the non-stop downward spiralling in market prices. There is a much anticipated worldwide expectation of a US rate cut in September 2024. Based on US inflation reports and moderate job growth data, it seems chances of a rate cut is indeed high. Keeping my fingers crossed that the recent rally in price is permanent with more to come. However, Geopolitics such as the upcoming US Presidential Election (Trump appears to be the favourite to win now after his assassination) and also escalating Middle East conflicts between Israel and Iran back military groups are causing much uncertainty in global economies. There is also the very controversial Allianz offer that affects my current share-holdings in Income Insurance Ltd- please see further remarks under Portfolio 4 section below.

(Note: This portfolio is designed to provide immediate dividends for use as it is under my own CDP account and the dividends credited goes directly to my bank account.)

I have given up on Capitaland Investment Limited and sold off all my holdings in it. The proceeds were used to purchase additional units of Keppel Ltd stocks at S$6.62 per unit.

2. Portfolio 2- Margin purchased securities

(Note: My margin purchased securities has grown to a sufficient scale to sustain itself and can pay off annual financing charges as well as to gradually pay down the margin loan through dividends generated.)

I have took profit and sold off all my Ping An Insurance shares. Have used the proceeds to purchase Link REIT as well as to pare down on expensive margin loan. Margin loan thus went down from S$291K to S$281K.

Also took a small speculative 5000 units trade in Mapletree Industrial Trust when its price plummeted to S$2.10 per unit and took profit 2 weeks later @S$2.29 per unit after the SREIT rally.

3. Portfolio 3 (with Tiger Brokers and MooMoo)

(Venture into higher risk as well as capital growth stocks here)I have took profit and sold off all my Ping An Insurance shares. The proceeds were used to purchase additional Link REIT units when its price plunged to below HK$30 range (HK$29.80) per unit. Also opened up a small position in a penny stock, Oceanus, which had seen continued strong growth in its food distribution business in China.

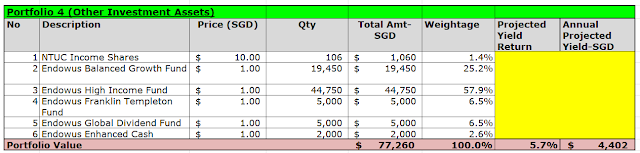

4. Portfolio 4 (Endowus Unit Trusts & Other Investments)

I have continued to build up my bond funds investment via Endowus platform.

Guess the only news-worthy update here is that my NTUC Income shares market value will go up from S$1,060 to S$4,300 if the controversial Allianz offer gets approved by local regulator and shareholders. The 2 formers CEOs of NTUC Income Co-operative have come out to speak out against the deal as they do not want the insurance group to lose track of its social goal to provide cheap insurance to the lower income of Singapore society.