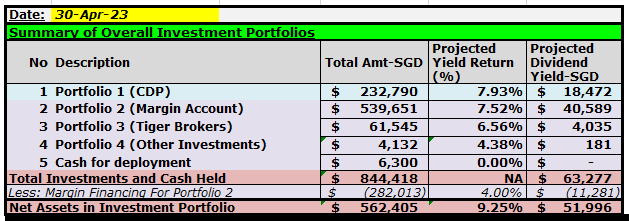

The stock markets continue to drop relative to my last portfolio update on 6th March 2023. Market talks by experts and analysts kept hampering on an upcoming global recession soon. There is no better time to invest to continue to build up one's investment portfolios over these downturn period. Current projected passive income from above portfolios is around +S$52K per annum (please also refer to my other Family Portfolio under management which is projected to yield +S$17K per annum).

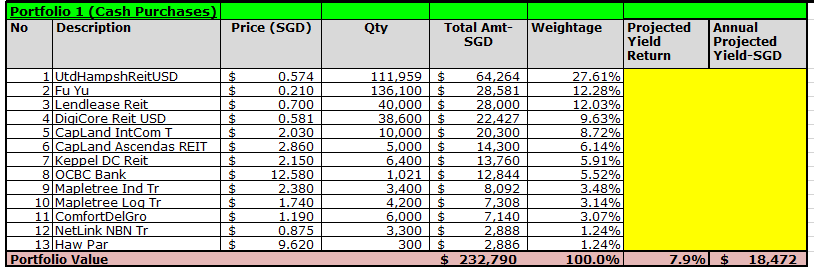

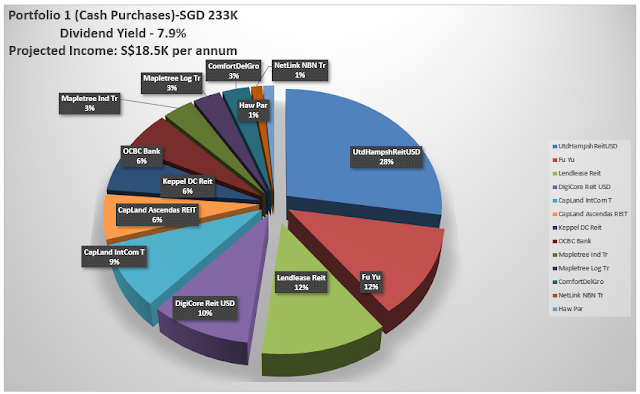

1. Portfolio 1- Stocks held in SGX Central Depository

(Note: This portfolio is designed to provide immediate dividends for use as it is under my own CDP account and the dividends credited goes directly to my bank account.)

2. Portfolio 2- Margin purchased securities

(Note: My margin purchased securities has grown to a sufficient scale to sustain itself and also to repay annual financing charges as well as to gradually pay down the margin loan through dividends generated.)

For upcoming months, I will continue to focus on paying down the margin loan as high interest rate is here to stay for another year at least and all my REITS holdings prices are still badly bruised from higher finance cost.

Changes over the past 2 months include purchase of Hong Leong Finance, Netlink Trust as well as additional accumulation of ComfortDelgro.

3. Portfolio 3 (with Tiger Brokers)- Venture into higher risk as well as capital growth stocks here

(i) Sold off DigiCore REIT after some capital gain and bought into Manulife US REIT when its price suddenly plummeted below US$0.20 per unit due to its debt crisis-awaiting further announcement from the Mirae deal by Manulife US REIT's management.

(ii) Added 100 shares into Alibaba when its price dropped back to HKD80 plus region. Seriously wondering whether Alibaba will be paying out dividends in future since it is spinning off its various business and will just be a holding company.

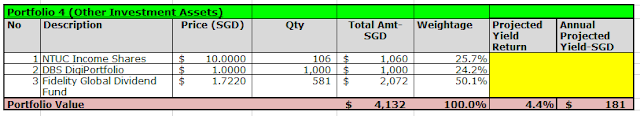

4. Portfolio 4 (Other Investments)- Non-listed equities,DBS DigiPortfolio + Endowus

I have invested into Fidelity Global Dividend Growth Fund using Endowus. However, I think I will go for Endowus's Income Portfolio later on- the minimum entry for Endowus Income Portfolio is S$10K.

I have invested into Fidelity Global Dividend Growth Fund using Endowus. However, I think I will go for Endowus's Income Portfolio later on- the minimum entry for Endowus Income Portfolio is S$10K.

Summary

Eventually, I will be increasing my passive income generation using Endowus's Income Portfolio which offers a very broad banding of diversification in global equities and global bonds including Asian high yield fixed income. I will probably build this up to 30% of my entire investment portfolios.