Dasin Retail Trust ("Dasin") S$500Mil syndicated bank loan is still in limbo despite the past 2 loan extensions- latest extension being given is from 20 December 2021 till 19 March 2022. Once again, there is not much news or disclosure from the Senior Management of Dasin with regard to the status of the syndicated bank loan albeit the deadline of 19th March 2022 fast approaching. The unit price of Dasin has been severely punished by the market and has dropped from its 52 weeks high of S$0.765 per unit to S$0.310 at its lowest point due to the high possibility of bank loan default. As at 11 March 2022 (Friday), the unit price of Dasin recovered slightly back to S$0.340 per unit. The late payment of distribution for the 1st half of FY2021 as well as the repeated failures to renew the syndicated bank loan for the long term have dented investors' confidence and it looks like Dasin will keep trading well below its NAV of S$1.40 per unit for a very long time. In addition, the free cashflow analysis which I came up with seems to be pointing to an unsustainable current distribution rate from Dasin in the long run (I will elaborate this point later on).

1. Dasin Retail Trust 15.4% Distribution Yield Per Annum- Typical Value Trap Or A Hidden Gem?

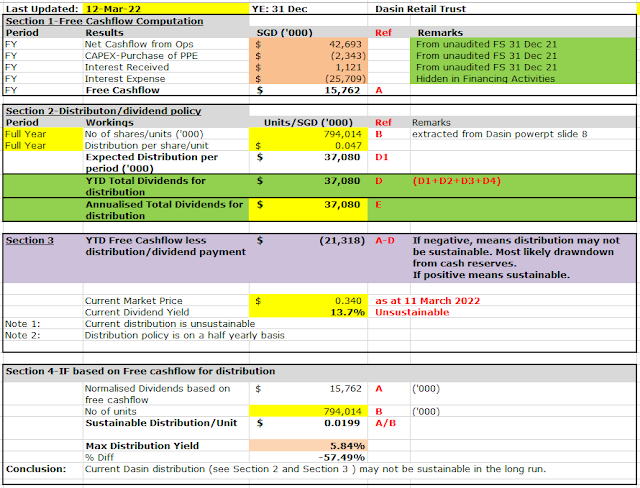

First and foremost, the super high +15.4% distribution yield is due to distribution waiver by the substantial unit-holders. The income waiver over the past few years end on FY2021. Going forward, there will no longer be waived since the business is deemed to have stabilized. Without the income waiver by the sponsor, the distribution yield will only be at +13.7%. This may still appear high but there are 4 main worrying points to take note in case one thinks that Dasin at its current price is a hidden gem and cash cow.

1(a) Worrisome plunge in fair valuation of its shopping malls for 2 consecutive years even as COVID brought under control in China in 2021

In FY2021, fair value of its shopping malls dropped by <S$62.8Mil>. In FY2020, this fair valuation was <S$105Mil>. Total fair valuation decline over the past 2 years combined is <S$167.8Mil>. Since the valuation methodology is based on discounted future cashflow by Jones Lang LaSalle, this means that expected future cashflow has plunged. This maybe attributable to higher interest rate and also lower occupancy rate [please see 1(b) below].

1(b) Occupancy rate of its mall has dropped further

As at 31 Dec 2021, occupancy rate of the shopping malls have dropped to 93.9% relative to 96.5% as at 31 Dec 2020. This is strange considering that by FY2021, the COVID situation I thought is already better managed in the whole of China.

1(c) Is the free cashflow available for distribution sustainable on a longer term?

The free cashflow does not seemed sufficient at all and being financed from current pool of existing cash balances. This will dwindle over time. The current distribution by Dasin is unsustainable in the longer run. If based on free cashflow, the sustainable distribution yield will only be +5.84%. This is where I find it extremely worrying. I will probably do a more in-depth analysis on this enigmatic issue if Dasin survived the upcoming bank loan default.

1(d) Can't help but wonder whether the numbers reflected in its financials and presentation are reliable

In addition, I sometimes wonder whether the numbers presented in Dasin's financial are reliable.

-Are there also as many tenants still operating in the different malls with good footfall from shoppers?

-Are there also huge unrecorded liabilities that is waiting to pounce on unsuspecting unit-holders?

-Does the bankers have in possession certain unfavorable information that is why the refusal by some of them to to refinance the syndicated bank loan even after 2 extensions?

However, to be fair, not all signs are gloom and doom with regard to Dasin as I will further elaborate in Paragraph 2 and Paragraph 3 below.

2. Reputable new trust manager and major shareholder-Sino Ocean

Sino-Ocean Capital is listed on the HKSE. So at least there is a glimmer of hope that the bankers will be willing to re-finance the loan given the better reputation and financial position of Sino-Ocean.

3. NAV of Dasin is at S$1.40 per unit- Market Price/NAV ratio of an incredulous 0.243

If one look out the latest China Retail Focused REIT/BizTrust Comparison by Vince on REIT-TIREMENT, we can do a rough comparative benchmark to similar retail REITs as follow:

-BHG Retail- 0.59

-Sasseur REIT- 0.88

If we are conservative, we can just use the lower BHG Retail REIT's ratio of 0.59 as reference benchmark. So, if Dasin managed to survive the bank loan renewal crisis, then its fair market value may have a potential upside of recovering to S$0.826 per unit. This is a whopping 147% potential upside in capital appreciation. Of course, this is just a speculation as I am somehow unable to figure out the root cause of the low free cashflow for Dasin as alluded to paragraph 1(c) as aforesaid mentioned. This is also subject to the reliability of the financial figures being provided by Dasin with no hidden surprises.

Parting thoughts

The free cashflow evaluation seems to be pointing to a future cut in distribution to unit-holders as it is not sustainable in the longer run since it is being drawn down from available cash and leverage. Anyway, this intriguing issue is not important right now. The upcoming deadline for renewal of the bank loan is perhaps the crux issue for Dasin now as it will determine whether there will be an immediate rights issue to repay the syndicated bank loan or a forced liquidation of investment properties. Saying that, there is also the possibility that the end of Dasin is once again postponed by the bankers should they choose to kick the can down the road for another 3 months extension on 19th March 2022.

No comments:

Post a Comment