Netlink Trust ("Netlink") seems to be back to a free cashflow deficit position again for FY2023. This means that it is borrowing from bankers to finance its CAPEX or if we put it bluntly, this means that part of the distributions back to unitholders for FY2023 is being funded from borrowings instead of earnings and will not be sustainable in the long run. Please see the YouTube version on my channel.

Who dares win.....create your own passive income and achieve financial independence. Be in control of your own destiny.

Wednesday 30 August 2023

Tuesday 29 August 2023

Netlink Trust 6.1% Distribution Yield Not Sustainable For Long Term- FY2023 Distribution More Than Free Cashflow Again.

Netlink Trust ("Netlink") seems to be back to a free cashflow deficit position again for FY2023. This means that it is borrowing from bankers to finance its CAPEX or if we put it bluntly, this means that part of the distributions back to unitholders for FY2023 is being funded from borrowings instead of earnings and will not be sustainable in the long run. I initially thought that this issue has already been resolved 3 years back as I understand that in one of the previous AGM (please see the comments section of this post), the management had mentioned that they will pay out distribution after taking into consideration the free-cashflow.

1. FY2023 Distribution More Than Free Cashflow Again.

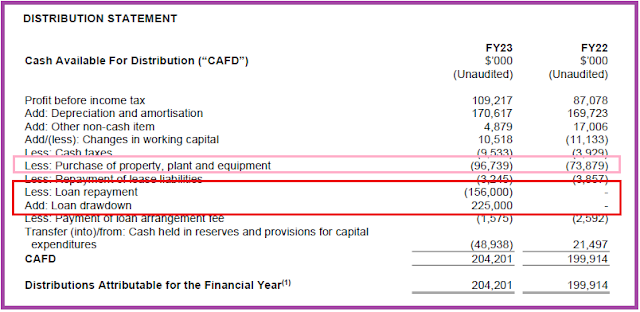

From the above computation screenshot using FY2023 full year numbers, the free cashflow generated is S$157Mil. However, it is paying out dividends of S$204Mil which exceeds the free cashflow by <S$47Mil>. The gap most certainly would have come from additional bank borrowings, so next step would be to drill down further for a sanity check using alternative verification on the Distribution Statement as per below screenshot.

From the Distribution Statement, we can see that Netlink incurred CAPEX ("Purchase of property, plant and equipment") of S$97Mil for FY2023, At the same time, Netlink repaid a loan of S$156Mil but strangely draw down a higher amount of bank loan of S$225Mil which is an additional <-S$70Mil>. Therefore, we can conclude that most of the CAPEX is being funded by bank borrowings or alternatively, we can also infer that 23% of the distribution is being paid for with bank borrowings since the existing cashflow is insufficient to finance such payout.

2. Anything Wrong With Paying For CAPEX Using Bank Borrowings Considering The Low Leverage Ratio of Netlink?

This is the question that is tough to answer. The only way that Netlink can grow its income is through organic growth as we have not seen any major M&A deals after many years. Netlink did indeed have growing revenue over the years albeit at a very slow pace. There is also the upcoming rates review by the Infocomm Media Authority ("IMDA") that is expected to increase the rates by 2%-3%. From an annual revenue of S$400Mil and assuming ceteris paribus, this will at most increase the free cashflow by +S$12Mil which still leaves a significant gap to plug the <S$47Mil> deficit.

Manulife US REIT used to be paying for CAPEX using bank borrowings as their management (via their investor public relation) mentioned that their gearing of 40% then is far from the 50% MAS statutory limit. But look how they ended up. I would rather Netlink management adopt a more conservative stance despite the "resilient" revenue from its business.

Parting Thoughts

Clearly, from the above, this kind of payout is not sustainable in the long run if the CAPEX remains high and pricing increase after the IMDA review is only 3%. The bad news is that the distribution yield will drop to 4.72% (instead of the current 6.13%) if Netlink were to purely pay out its dividend using free cashflow. Nevertheless, the good news is that if Netlink managed to get a higher rate hike increase from IMDA due to the severe inflationary pressures and if CAPEX came down, then the 6.1% distribution yield will still be sustainable for the longer term.

(Maybe folks who have been attending the AGMs or closely following up on Netlink can help share some input/comments into the sudden higher CAPEX of S$97Mil in FY2023 relative to S$74Mil in FY2022 to determine whether it is a one-off operational expenditure for FY2023).

Friday 25 August 2023

Family Portfolio Management Update-25 August 2023

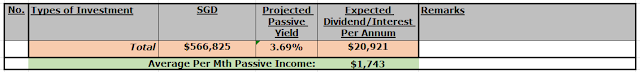

I am currently handling the above investments for my family members in accordance to their low risk tolerance and will be documenting this on my blog for ease of personal reference for this particular portfolio and also for general sharing purpose.

Current passive income generated from this particular portfolio is around +S$21K per annum from this portfolio (please also refer to my other Investment Portfolios under management which is projected to yield +S$53K per annum).

1. There were additional S$30K being injected into the Endowus Income Portfolio. This is a product with 80% invested into bond funds and another 20% in equity funds that seeks to payout 5.5% to 6.5% of distribution per annum. So far, my wife has been rather impressed with the Endowus Income Portfolio and is comfortable in it. Payout frequency from the many funds is on a monthly basis. In theory, Endowus has asserted that the capital should increase over time amidst the monthly payout.

2. Other overseas assets continued to underperform miserably and only generate 0.8% of passive income per annum.

3. The UOB savings account continues to generate an attractive 5% interest income per annum.

Will be further building up the Endowus Income Portfolio over the next few months.

Tuesday 22 August 2023

Updates on United Hampshire US REIT and Manulife US REIT- The Curse of the 9.8% Unit Holdings Limit Imposed On US REITs Sponsor.

Hi Folks, this is to follow up on my last United Hampshire US REIT ("UHREIT") post on whether rights issuance to all local unit-holders of US REITs- as a last resort to raise funds- is actually feasible in the event of a financial crisis faced by the REIT. According to the Investor Relation team of Manulife US REIT, this rescue option cannot work as each unit-holder can only hold up to 9.8% of units in such a setup and the sponsor are thus unable to step in. This is the one critical piece of information that no one thought is important for many years until the recent US Office REIT crisis exposed this aspect as the weakest link in the chain which can lead to devastating consequences for US REITs listed on SGX. What it means is that even if a sponsor (referring to US properties REIT) is financially strong, it throws a spanner into the works for the last available rescue option on the table- which is the equity fund raising exercise.

I have sent in an email query to UHREIT Investor Relation last week as well as attended the SIAS UHREIT Webinar session just now (22 Aug 2023; 7pm). The response has been quite general FAQ kind of answers which I do not blame them as UHREIT team can only work with disclosure that have already been made known to the general public. Mr Gerard Yuen (CEO of UHREIT) also kicked the can further down the road when rights issue question was raised citing it is in a very different asset class relative to what happened to the commercial office sector. I have pieced together some of the key points from what UHREIT is able to disclose as well as general information that are available online.

1. What exactly is this 9.8% unit-holding limit and the implications?

This is the maximum unit-holding that an individual can hold in the US REIT and is crafted into the Trust Deed as the foundation that is cleared and permitted by Uncle Sam. Any breach of this 9.8% limit will mean an immediate withholding tax being levied for distributions. To be more exact, a breach of this will not just mean an immediate withholding tax being levied on that particular unit-holder- it will apply to all local unit-holders. Since the general Withholding Tax Rate in US is 30%, so we can assume that the amount of distributions received will dive by a whopping 30%.

2. Any other consequences of a breach of this 9.8% unit-holding?

Using what happened to Manulife US REIT recently due to the breach of bank covenant and consequently no distribution being made, there will be additional corporate tax exposure once the REIT structure is being punctured.

3. Breach of this 9.8% will mean a breach of MAS requirement and be suspended from trading?

Nope, apparently this is more of a tax efficient vehicle issue. But the grave financial implication is that it will lead to further downward spiral in its pricing given the additional tax expenses and risk premium demanded by unit-holders.

Hence based on the above mentioned adverse consequences in Pt 1 and Pt 2, any recuse by the Sponsor via a rights issue that leads to excess subscription support will breach the 9.8% limit and lead to the unravelling of the structure being put in place. This is also why the sponsor of Manulife US REIT has not been keen to do a rights issue since commencement of the November 2022 Strategic Review.

4. Does that mean rights issue will not work for these US REIT during a financial crisis?

Not exactly. Let me try to explain 3 scenarios:

4(a) Scenario 1: Rights issue exercise with bankers stepping in to undertake excess unsubscribed rights

In a normal case, an US REIT will be able to get investment bankers to undertake any unsubscribed rights by paying an additional professional fees for stepping in to mop up the excesses. But for very risky cases like the structural demand challenges in US Office sector and the out of the world high interest rate environment, I don't think any sane bankers will dare to underwrite the rights issue for such REITs lest they get stuck in REIT equities that need to be written down to zero in a few months if things deteroiate further.

4(b) Scenario 2: All existing unit-holders are willing to subscribe to their entitlement hence 9.8% for sponsor remain intact

This scenario is an ideal scenario where the World as we know is PERFECT- every unit-holder do their part and their percentage unit-holdings remains the same after the rights issuance exercise. Unfortunately, we all know that this will never happen in real life. There will be unit-holders that will not subscribe due to individual unique circumstances as well as reasons.

4(c) Scenario 3: Rights issue exercise with existing unit-holders (besides the sponsor which is already at 9.8% max limit holding) willing to take up any unsubscribed excesses.

This is again another theoretical ideal case scenario whereby we are assuming other existing unit-holders are willing to pick up the slack for the Sponsor. These "other" unit-holders must also have deep pocket to be able to do this. Practically, this is very tough to execute with lots of coordination, unknowns and the rights exercise might fail to raise the required amount of funds.

Parting thoughts

I can only say that holding on to US REIT is extremely risky as having a good sponsor has limited value add point during crunch time. Once the management missed the opportune time to do a rights exercise, the REIT will most likely end up in a death spiral or take a long time to climb out of its woes. The 9.8% max limit imposed on the sponsor is the Achille's heel of holding US REITs. The one thing that is exceptional about United Hampshire US REIT relative to Manulife US REIT is that its strip centre properties are a very resilient asset class thus far which have performed extremely well over the past few years.

Dasin Retail Trust Trading Price Possibly Being Manipulated By An Unknown Individual Investor- Investors Beware!

Hi Folks, for those who are trading in Dasin Retail Trust ("DRT"), please be very careful. SGX Regulators have put up a notice that they have observed an individual investor who have pushed up DRT unit price by 46% during an intra-day low of S$0.063 per unit to S$0.092 per unit on 16th August 2023. There were various instances of possible price manipulation over the past month to maintain its price despite the bank loans default notice served by the bankers of DRT.

SGX regulators have referred the matter to the relevant authorities for their necessary action. Do tread with caution for those who are bargain hunting in DRT. Price may crash or trading may get suspended in the worst case scenario for DRT unit-holders. Take care and have a great week ahead!

Monday 21 August 2023

Aiya- Not Much Benefits Given By Government After National Day Rally!

To be honest, I was a tad disappointed by yesterday's National Day Rally as I do not qualify for much freebies given by our Prime Minister Mr Lee Hsien Loong. The S$7 billion "Majulah" goodies package is being reserved for 50years old plus this round. Nevertheless, I am happy that my parents will benefit from the one-off retirement as well as Medisave top up- think they are probably getting handout of S$2K each. Also, some additional good news for my elderly parents as Mr Lee has announced that there will be enhancement next year for the Silver Support Scheme. These measures do help the sandwiched class like myself who have to take care of elderly parents and support young kids some breather.

Other major announcement

The prime plus flat schemes for good located BTOs is interesting. Finally, the government decided to step in to plug the lottery effect loophole. For many years, some small group of lucky Singaporeans have been making a fortune selling their BTOs and using the enormous proceeds from such flat to upgrade to private property. I know of ex-colleagues who sold off their Pinnacle@Duxton flats and made obscence profits of S$500K- S$600K from the sales. I do hope that with a minimum occupation period of 10 years as well as being made to pay back part of their sales proceeds to HDB, this will make it fairer for all Singaporeans.

The prime plus flat schemes for good located BTOs is interesting. Finally, the government decided to step in to plug the lottery effect loophole. For many years, some small group of lucky Singaporeans have been making a fortune selling their BTOs and using the enormous proceeds from such flat to upgrade to private property. I know of ex-colleagues who sold off their Pinnacle@Duxton flats and made obscence profits of S$500K- S$600K from the sales. I do hope that with a minimum occupation period of 10 years as well as being made to pay back part of their sales proceeds to HDB, this will make it fairer for all Singaporeans.

HDB flat is meant for living and to help citizens have a roof over their head and not build private swimming pool or tennis court in such public development

Well, some people are not going to like what I am going to say next. Sorry but no offence intended, I seriously think that HDB should stop building Executive Condominiums ("EC"). HDB flats are for folks who need financial support for the absurdly priced housing in Singapore. So why waste space for EC which has luxurious facilities like swimming pool and tennis courts and also giving out generous grants? These space wasted could have been used to build additional block of flat in a plot of land and the EC grants be given instead to other Singaporeans who needed it more so as to have a roof over their head. The government should just leave the building of luxurious condominiums to the private sector instead of wasting resources to have such unnecessary amenities using public funds. I failed to see the reason why for folks who wanted luxurious swimming pools, gyms or tennis court in their home, then the common tax-paying folks have to subsidise their EC grants. If so, then why not build "Executive" Landed Property for those who aspires to stay in private landed property?

Parting thoughts

I think that HDB need to differentiate between essential needs and luxurious craving so as to be fair to tax-payers.

Thursday 17 August 2023

Latest 17 August 2023 Treasury Bills Results Out- Cut off Yield of 3.73%.

Hey Folks, the latest round of MAS Treasury Bill auction is out. The cut off yield is 3.73%. Total application sent in is a staggering S$11.8 billion and only S$5.6 billion were allotted. The earlier 3rd August 2023 auction for T-bills were going for a slightly higher 3.75%. I have applied for S$10K at a non-competitive bid on behalf of my family members.

The good thing about T-bills is that one is paid the coupon rate upfront unlike many fixed deposit where the interest is only paid out at the end of the duration.

(Note: I have also started my own You-Tube Channel- please click here to follow & subscribe to support content creation)

Saturday 12 August 2023

United Hampshire US REIT Announced Another Set of Resilient 1st Half Results-12.86% Distribution Yield.

United Hampshire US REIT ("UHREIT") announced another set of stellar half year results. Its Gross Rental increased +13.3% while Net Property Income increased +14% relative to its prior 1st Half FY2022. It has also successfully improved committed occupancy for its groceries and necessities properties to a record high of 97.9% with new and renewal leases totalling 331K sqft being signed in the 1st half of FY2023. At the price of US$0.42 per unit as at 11 August 2023 and a distribution declaration of 2.65cents per unit, UHREIT is effectively giving out an annualised distribution yield of 12.86% and this is notwithstanding an amount of US$1.5Mil being retained by its management for asset enhancement initiatives (the distribution yield would have been even higher at 13.86% if all of it are marked for payout). Congrats to all fellow current unit-holders who have been taking market risk to hold on to this US REIT!

(Note: I have started my own You-Tube Channel and has uploaded a video on UHREIT there- please click here to follow & subscribe.)

1. Quick Review of Financial Results for 1st Half 2023.

As aforesaid mentioned, the net property income has increased by 14%. However, the finance cost has went up by a whopping 72.7% which thus dragged down the overall net income before tax and fair value changes by -1.4%.

One point to note here is that for "Fair Value changes to investment properties or financial derivatives", these have no effect on the cashflow and distribution payout unless they are realised.

From the financial statements, there are actually 2 key risks that one should take note of and which I will elaborate further in the final portion on "Parting Thoughts" section later on.

2. Debt Profile Status of UHREIT

UHREIT has no major refinancing exercise coming up until November 2026. For 2024, there is a small tranche of US$21.1Mil of mortgage loan maturing only. Moreover, 80.9% of its debt are fixed interest at a weighted rate of 3.57%.

Aggregate leverage is at 42% which personally to me is on the high side- Please see UHREIT planned disposal of Big Pine Centre in section 3 below to repay part of its debt to bring down this ratio.

3. Planned disposal of Big Pine Centre at 3.7% Premium to Valuation

As part of its proactive portfolio and asset management strategy, the Manager has entered into an agreement to divest Big Pine Center, Florida, for a sale consideration of US$9.9 million. The consideration represents a 3.7% premium over the 31 December 2022 appraised value of US$9.5 million, and 7.7% premium over the purchase price of US$9.2 million.

Assuming the net proceeds are used to repay debt, UHREIT’s proforma gearing is expected to be reduced by 0.8%.

4. Million Dollar Question On UHREIT's Investment Properties Outlook- Will It Go Down the Road Of Manulife US Office REIT or Prime US Office REIT?

Interestingly, the Green Street Property Price index indicates that the remote work from home arrangement post COVID pandemic which severely affects US Office Commercial properties actually benefitted the Strip Centre sector which is the key properties held by UHREIT. Apparently, workers working from home increased the demand for the goods and services offered in Strip Centres.

From June 2020 to June 2023, the valuation of Stripe Centre increased 19%.

Similarly, Self-Storage properties (this is also one of the type of commercial property held by UHREIT but to a lesser extent) valuation went up by 58% over the past 3 years.

Parting Thoughts

The 2 key risks faced by local unit-holders of UHREIT are (i) forex risk arising from weakening USD due to wide-spread money printing by the US Fed and (ii) the high aggregate leverage ratio of 42% which makes is susceptible to breaches of bank loan covenants that automatically lead to loan default should there be structural headwinds in demand or higher interest rates hikes in the event that the inflationary monster comes back.

In addition, the structural setup of UHREIT seems to be eerily similar to Manulife US REIT which leads to a further question on whether rights issue to all unit-holders- as a last resort to raise funds- is actually feasible in the event of a debt crisis. According to Manulife US REIT, this rescue option cannot work as each unit-holder can only hold up to 9.8% of units in such a setup and the sponsor are thus unable to step in. This render having a "reputable and financially strong" sponsor as good as useless. I will probably be sending out queries to the management/public relation team of UHREIT to find out more.

Wednesday 9 August 2023

Fu Yu Corporation Sliding Into Oblivion- Once Remarkable Cash Cow Becomes Bleeding Cow.

Fu Yu Corporation which used to give out high dividend yield of 7% is in an imminent crisis. For the past 12 months, Fu Yu Corporation share price has been

spiralling non-stop downwards. From S$0.265 per

share 12 months ago to S$0.160 per share as at 8 August 2023, this is a whopping 40% collapse in its share price. There have been a few red flags that have arisen at Fu Yu Corporation which I should discuss further below. In summary, it began with the resignation of their ex-CFO in late 2022 and more recently, a dire profit warning released by Fu Yu's management on expected losses for the 1st half of FY2023.

(Note: I have started my own You-Tube Channel and has uploaded a video on Fu Yu Corporation there- please click here)

1. Resignation of CFO

The CFO of Fu Yu Corporation Miss Hee Siew Fong has resigned in Quarter 4 of 2022. This event has always been lingering on my mind. Miss Hee was only 51 years old, which is still a relatively young age, for a CFO to want to leave. She has been with Fu Yu Corp and the previous management for 7 years. Within a short span of the new management taking over, Miss Hee has resigned. It was announced on 7 October 2022 that the Company and Miss Hee have agreed to part ways mutually by a settlement agreement. Personally, I think that the enigmatic resignation may have been a clash in terms of vision or direction such as future business strategic growth differences. It may also have to do with clash in financial resource allocation. Also, I have seen in some cases the resignation of key accounting and finance personnel (except for genuine old age retirement) does not bode well for an organization.

2. New Supply Chain Management Low Margin and Risky

The new supply chain management service segment by the new Management sucks big time with very tiny net profit margin percentage. This is as good as not doing it. Initially, I thought that Fu Yu has got a new growth engine with this supply chain management services segment introduced by the new management team. For FY2022, this business contributed a staggering S$100Mil dollars in terms of revenue to Fu Yu but only contributed a tiny net profit of S$1.9Mil dollar which is a mere 1.9% net profit margin. I have no idea how this business works and also the risks associated. Initially, I thought that this is like a back to back consolidation of trade in physical commodities with minimal risk but I was totally wrong.

For Quarter 1 2023, this new business turned into a net loss of S$2.4Mil dollars on a revenue of S$9.7Mil. I think that it is a waste of management time to be devoting resources & efforts to this business and that the management team should just sell it off and focus on its core manufacturing business and transformation map 2.0. The risk and reward ratio does not align or make sense to me personally especially in view of the Quarter 1 2023 business updates.

3. Profit Warning

Unfortunately, the worst has yet to come. On 28 July 2023, the Board of Directors of Fu Yu Corporation released a profit warning to inform shareholders that the Group is expected to report a net loss for first half of 2023. It appears to me that the new management of Fu Yu Corporation is running the Company to the ground.

Parting Thoughts

I have already sold off all my Fu Yu shares in early June of 2023 as I became extremely disillusioned with the new management team. I have re-deployed capital to other investments as I think that the good old days of Fu Yu Corporation being a cash cow is over. Instead, Fu Yu has turned into a profusely bleeding cow.

Tuesday 8 August 2023

Sabana REIT Unitholders Bumped Off Sponsor's REIT Manager At Historic EGM.

Wow, what a dramatic twist at the recent Sabana REIT's Extraordinary General Meeting ("EGM") on 7th August 2023 which marked a historic milestone in Singapore REITs and the rise of shareholder activism. I was not expecting the removal of the REIT Manager motion to go through due to the unknown chapter that lies ahead in re-financing the bank loans over the next 1 year lead time while the REIT's Trust internalise the REIT Manager. Imagine the moment when the voting result was revealed with 55.6% of unitholders votes casted to get the motion through- the sponsor ESR Group must have been utterly stupefied at that juncture with their worst nightmare coming through.

1. Sabana unitholders to be commended

I am absolutely impressed by the fighting spirit of existing unit-holders who voted for the removal of the current Manager. ESR Group had previously made a low ball offer to buy-out Sabana REIT at S$0.31 per unit (current trading price is at S$0.405 per unit). The resolute stand that they took to remove the manager, which is more interested in their Sponsor's interest, rather than objectively for the rest of the unit-holders is commendable. Well done! The EGM has proven that size doesn't matter, it's the Heart and Courage of retail investors that matters.

2. Sponsor taught a great lesson not to treat unit-holders as "Carrot Head"

The low ball offer and value destructive merger leaning heavily towards the interest of ESR Group is simply shameful and deplorable. Through control of the REIT Manager, they tried to present it as a fair and reasonable M&A deal in 2020. The historic moment that transpired at Sabana REIT's EGM will resonate through all Singapore REITs. Sponsors now need to open their eyes to the adverse consequences from making low ball offers or unfair deals that are prejudicial to the interest of other minority unit-holders. They may lose the lucrative management fees of a REIT Manager if they persist in such unfair dealings.

Parting thoughts

Quarz Capital had once again made their mark as an activist investor against Goliath. Quarz had also made a strategic and smart move to ask existing staff of the REIT Manager to stay on and dangled an improved remuneration package- this brilliantly takes care of the continuity issue of daily operations and accounting.

Sunday 6 August 2023

Saying Goodbye To Hong Leong Finance!

Hong Leong Finance ("HLF") released a set of extremely disappointing 1st half 2023 results that was far below my expectation and a far cry from its stellar 2nd half 2022 results. While HLF posted a 3.2 per cent rise in net profit to S$46.6 million for the first half ended 30 June 2023 relative to 30 June 2022, I was expecting the profits to increase by at least 50%. The miserly management have also reduced the interim dividends to 3.5 cents per share relative to previous year 3.75 cents despite the better profit numbers. (Note: For those who prefers You-Tube Video on this, please click here)

I have sold off all 10,000 shares in HLF that I have accumulated in different tranches from Feb 2023 to July 2023 and realized a paltry annualised profit of 9.98%. Think it will be more worthwhile to invest in the 3 local banks or other SREITs rather than HLF. Will probably re-deploy the capital if the market presents a good entry opportunity.

Friday 4 August 2023

Alamak! Tan Kin Lian Running For Singapore President Again---Can Someone Please Stop Him?

This is really OMG!. The former chief executive of NTUC Income Insurance Cooperative is coming out to run for the Singapore Presidency again. In 2011, Mr Tan Kin Lian came in last out of four candidates with only 4.91% of the total votes and immediately lost $48,000 of his election deposit for failing to garner more than one-eight of the total votes.

1. The savior of Singapore-Mr Tan Kin Lian

Again, with guns blazing, Mr Tan Kin Lian started blabbering weird stuff about influencing government policies if elected and he proudly proclaim that he will use the President's veto powers to ensure that government policies align with his vision and goals.

"Mr Tan’s aim is unrealistic and misleading", said political analyst at Nanyang Technological University (NTU) Felix Tan. “That is not the role of the President. They do not guide policies, to begin with. That’s the role of the government of today.” Please refer to Channel NewsAsia.

2. Sparring with Mr Tan while he was in NTUC Income Insurance

I had some personal interaction with Mr Tan while he was the boss of NTUC Income Insurance. Many years back, whole-life limited payment plan just came out. I was a NTUC Income policy holder. I wrote in to feedback to him that NTUC Income should learn from other insurance companies like Aviva which are offering premiums payment of 10 years to 20 years limited payment for whole-life plan instead of NTUC Income traditional policy of paying till one is age 85 years old (pay whole-life indeed even after your retirement). Mr Tan jumped the gun and replied in a hostile manner to demand to know whether I am an agent from other rival insurance company. This left a lasting bad impression on me about his personality.

3. Have you heard him speak publicly?

In 2011, there were various interviews held with the different presidential election candidates. I almost fainted when I hear him speak. Personally, I think I will die from embarrassment if he was ever elected as our Head of State representing Singaporeans.

Parting thoughts

I am not sure why the Presidential Elections Committee allowed Mr Tan Kin Lian to run in 2011 Presidential Election. I hope they don't make the same mistake again and disqualify him immediately for 2023. This will also help Mr Tan save his deposit and hard-earned money from being forfeited.

Subscribe to:

Posts (Atom)