I am currently handling the above investments for my family members in accordance to their low risk tolerance and will be documenting this on my blog for ease of personal reference for this particular portfolio and also for general sharing purpose.

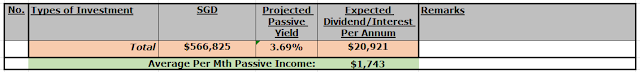

Current passive income generated from this particular portfolio is around +S$21K per annum from this portfolio (please also refer to my other Investment Portfolios under management which is projected to yield +S$53K per annum).

1. There were additional S$30K being injected into the Endowus Income Portfolio. This is a product with 80% invested into bond funds and another 20% in equity funds that seeks to payout 5.5% to 6.5% of distribution per annum. So far, my wife has been rather impressed with the Endowus Income Portfolio and is comfortable in it. Payout frequency from the many funds is on a monthly basis. In theory, Endowus has asserted that the capital should increase over time amidst the monthly payout.

2. Other overseas assets continued to underperform miserably and only generate 0.8% of passive income per annum.

3. The UOB savings account continues to generate an attractive 5% interest income per annum.

Will be further building up the Endowus Income Portfolio over the next few months.

Sounds like endowus is better than Syfe. My Syfe equities portfolio forever in the red. How reliable is Endowus? Also, would you not add some NLT in?

ReplyDeleteHi Damn, no lah….dun think Endowus is better than Syfe or Sfye better….most of the funds vastly similar on both platforms. I think more of timing as in when entered into the market.

DeleteFor example, if one have invested on Endowus SPY500 when it was at 4,800 range, then one’s investment would still be in the red.

I have commenced moving my family and personal portfolios into Endowus to focus more on bonds as I believe that we are near the peak of interest rate hikes so as to diversify the portfolios as well as to take advantage into fixed income return.

What is NLT? Are you referring to NetLink Trust?

Yes Netlink Trust. Since we expect peak interest rate, ideal to pick something with limited downside. ($0.77, 2020)

ReplyDeleteIf I'm wrong I'll just wait it out. If I'm right, then it'll cross back $1.

Hi Damn, I am vested in Netlink Trust also. The problem with NetLink Trust is that its distribution is not sustainable by its free cashflow. The Management is using bank borrowings to finance its CAPEX. The actual distribution needs to drop by around 23% to 25%. I will probably do another posting on this. The last analysis I done was 3 years ago and seems that NLT is still using borrowings to finance the CAPEX and distributions.

Delete