Netlink Trust ("Netlink") seems to be back to a free cashflow deficit position again for FY2023. This means that it is borrowing from bankers to finance its CAPEX or if we put it bluntly, this means that part of the distributions back to unitholders for FY2023 is being funded from borrowings instead of earnings and will not be sustainable in the long run. I initially thought that this issue has already been resolved 3 years back as I understand that in one of the previous AGM (please see the comments section of this post), the management had mentioned that they will pay out distribution after taking into consideration the free-cashflow.

1. FY2023 Distribution More Than Free Cashflow Again.

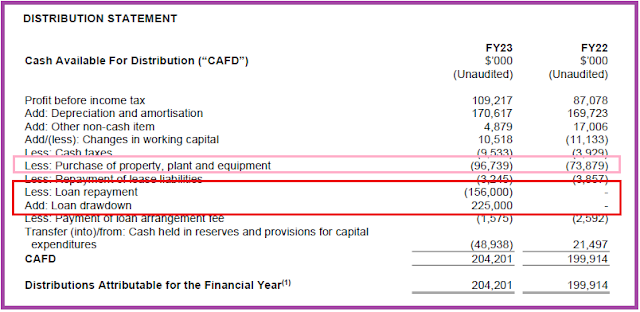

From the above computation screenshot using FY2023 full year numbers, the free cashflow generated is S$157Mil. However, it is paying out dividends of S$204Mil which exceeds the free cashflow by <S$47Mil>. The gap most certainly would have come from additional bank borrowings, so next step would be to drill down further for a sanity check using alternative verification on the Distribution Statement as per below screenshot.

From the Distribution Statement, we can see that Netlink incurred CAPEX ("Purchase of property, plant and equipment") of S$97Mil for FY2023, At the same time, Netlink repaid a loan of S$156Mil but strangely draw down a higher amount of bank loan of S$225Mil which is an additional <-S$70Mil>. Therefore, we can conclude that most of the CAPEX is being funded by bank borrowings or alternatively, we can also infer that 23% of the distribution is being paid for with bank borrowings since the existing cashflow is insufficient to finance such payout.

2. Anything Wrong With Paying For CAPEX Using Bank Borrowings Considering The Low Leverage Ratio of Netlink?

This is the question that is tough to answer. The only way that Netlink can grow its income is through organic growth as we have not seen any major M&A deals after many years. Netlink did indeed have growing revenue over the years albeit at a very slow pace. There is also the upcoming rates review by the Infocomm Media Authority ("IMDA") that is expected to increase the rates by 2%-3%. From an annual revenue of S$400Mil and assuming ceteris paribus, this will at most increase the free cashflow by +S$12Mil which still leaves a significant gap to plug the <S$47Mil> deficit.

Manulife US REIT used to be paying for CAPEX using bank borrowings as their management (via their investor public relation) mentioned that their gearing of 40% then is far from the 50% MAS statutory limit. But look how they ended up. I would rather Netlink management adopt a more conservative stance despite the "resilient" revenue from its business.

Parting Thoughts

Clearly, from the above, this kind of payout is not sustainable in the long run if the CAPEX remains high and pricing increase after the IMDA review is only 3%. The bad news is that the distribution yield will drop to 4.72% (instead of the current 6.13%) if Netlink were to purely pay out its dividend using free cashflow. Nevertheless, the good news is that if Netlink managed to get a higher rate hike increase from IMDA due to the severe inflationary pressures and if CAPEX came down, then the 6.1% distribution yield will still be sustainable for the longer term.

(Maybe folks who have been attending the AGMs or closely following up on Netlink can help share some input/comments into the sudden higher CAPEX of S$97Mil in FY2023 relative to S$74Mil in FY2022 to determine whether it is a one-off operational expenditure for FY2023).

There's another issue that was seldom mentioned. As NLT pay out dividend, the NAV keep dropping. This reminds me of Shipping Trusts like First Ship, Rickmers, etc, that was hot in the 2000s. Many investors bought it due to high dividend yield until it crashed.

ReplyDeleteHi Henry,

DeleteYup, Netlink Trust NTA does keep dropping because it is taking up loans to pay for its CAPEX and distributions. Hope it does not end up in the gutters and there are good news coming out of the IMDA rate review exercise for Netlink Trust.