The stock markets had a good recovery over the last week. However, my portfolio remains in the doldrum-all additional capital injection over the past 6 months into the SGX seems to be sucked into a bottomless blackhole. I have made some adjustments to the dividend income yield projection listed on StocksCafe for US office REITs by taking a further haircut of 25% to reflect forward dividend returns. (Note: Please also refer to my other Family Portfolio which is projected to yield +S$20K per annum).

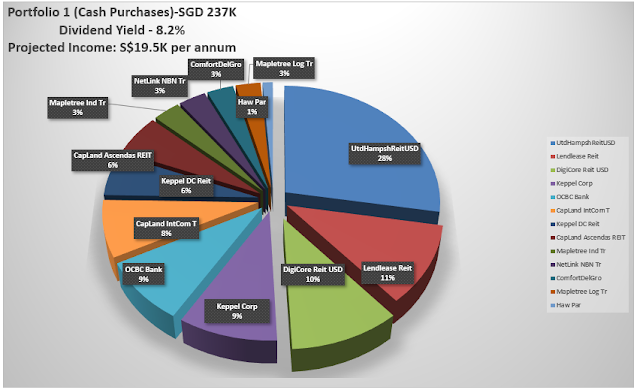

1. Portfolio 1- Stocks held in SGX Central Depository

(Note: This portfolio is designed to provide immediate dividends for use as it is under my own CDP account and the dividends credited goes directly to my bank account.)

The major change here was the selling off of Fu Yu Corp and switching to Keppel Corp and OCBC over the past 1 month- please read more here: "SGX Listed Fu Yu Corporation No Longer A Cash Cow- 3 Things To Be Wary". I have been building up my position in Keppel Corp, which is similarly undergoing a business transformation, in both my Portfolio 1 and Portfolio 2.

I have also been busy building up additional stakes in Netlink Trust to ensure sufficient diversification away from REITs.

I have also been busy building up additional stakes in Netlink Trust to ensure sufficient diversification away from REITs.

2. Portfolio 2- Margin purchased securities

(Note: My margin purchased securities has grown to a sufficient scale to sustain itself and can pay off annual financing charges as well as to gradually pay down the margin loan through dividends generated.)

(i) On 5th May 2023, I have sold off all my 16,000 units of holdings in Mapletree PanAsia Commercial Trust @S$1.72 per unit. All proceeds have been reinvested into Keppel Corp. Please read more here: " Saying Goodbye to Mapletree Pan Asia Commercial Trust".

(ii) Added 4,000 units of AIMS APAC REIT during its recent rights issue exercise to finance AEI initiatives. Please see "AIMS APAC REIT Announced Fund Raising For Asset Enhancement And Property Redevelopment- Important Timelines To Take Note".

3. Portfolio 3 (with Tiger Brokers)- Venture into higher risk as well as capital growth stocks here

Sold off whatever remains of Fu Yu Corp and partial disposal of Alibaba and switched to DigiCore REIT. Please refer to my previous post on rationale: "US Digital Core REIT- Worst Maybe Over With Unraveling of Stalking Horse Bid by 16 July 2023".

4. Portfolio 4 (Other Investments)- Non-listed Equities+ Endowus

(a) I have added PIMCO GIS Income Fund and Allianz Global High Yield Fund to my existing Fidelity Global Dividend Fund in Endowus to create a "Balanced Fund" portfolio that targets to return distribution of 5.5% yield per annum. This is a 20% equities and 80% fixed income portfolio- the equity component will allow one to still have some upsides in terms of long term capital appreciation from global equities on top of having a high distribution payout on a monthly basis.

(b) The Endowus Secure Cash a money market fund that is offering a target of 3.7% to 3.9% annual return on cash placed. Withdrawal can be anytime and there is no lock in period.

(c) The Endowus Enhanced Cash seeks to pay out higher distribution of 4.2% to 4.5% per annum. Have put some funds here also to test run. So far, the return has been worst than the Endowus Secure Cash with negative returns on some days.

Summary

I am extremely disappointed with my Alibaba holdings which seems to have become a value trap and incurring lots of opportunity cost. The only consolation is that I have stopped adding on to it and Alibaba forms only a small portion of my overall portfolios. Nevertheless, I will still be holding on to the remaining Alibaba shares and hope that with the upcoming IPO of the major business divisions, it can finally unlock value for the long debilitated share price.

No comments:

Post a Comment