Recently, I had a review of some of my existing holdings in my portfolios and I was disappointed that Fu Yu Corporation ("Fu Yu") share price performance has been slipping. Its unit price has dipped from its S$0.210 average to S$0.178 per share. The worst aspect is that its key manufacturing performance, post the buy-out of the old management team, seems to be sliding from bad to worst. Management has also slashed the usual dividends payout in May'23 relative to prior years. I have already commenced cutting down the majority of my stakes in Fu Yu Corp (87% reduction) after taking a deep dive into its latest 2023 Q1 operation updates as well as its most recent full year financial statements and will only keep a tiny stake of 20,000 units (approximately S$3,580 @S$0.178 per share as at 1 June 2023). There are 3 points that is currently giving me a jittery vibe with regard to the current Fu Yu Management team albeit the common understanding that the global economic situation has slowed down drastically and affecting their business.

1. Fu Yu previous CFO Ms Hee Siew Fong (aged 51 years old) has resigned in Q4 2022

This event has always been lingering on my mind with regard to Fu Yu. Ms Hee was only 51 years old which is still a relatively young age for a CFO to want to leave. She has been with Fu Yu Corp and the previous management for 7 years. Within a short span of the new management taking over, Ms Hee has resigned. It was announced on 7th October 2022 that the Company and Ms. Hee have "agreed to part ways mutually" by a settlement agreement.

Personally, I think that the enigmatic resignation may have been a clash in terms of vision or direction such as future business strategic growth differences. It may also have to do with clash in financial resource allocation. Also, I have seen in some cases the resignation of key accounting and finance personnel (except for genuine old age retirement) does not bode well for an organization.

2. The new supply chain management service segment by the new Management sucks big team with very tiny net profit margin percentage- as good as not doing.

Initially, I thought that Fu Yu has got a new growth engine with this supply chain management services segment introduced by the new management team. For FY2022, this business contributed a staggering S$100Mil in terms of revenue to Fu Yu but only contributed a tiny net profit of S$1.9Mil which is a mere 1.9% net profit margin.

I have no idea how this business works and also the risks associated. Initially, I thought that this is like a back to back consolidation of trade in physical commodities with minimal risk but I was totally wrong. For Q1 2023, this new business turned into a net loss of <S$2.4M> on revenue of S$9.7Mil.

I think that it is a waste of management time to be devoting resources & efforts to this business and that the management team should just sell it off and focus on its core manufacturing business and transformation map 2.0. The risk and reward ratio does not align or make sense to me personally especially in view of the Q1 2023 business updates.

(Note: Also, from the AGM queries, apparently, I am not the only shareholder expressing concern about this "new supply chain management" business).

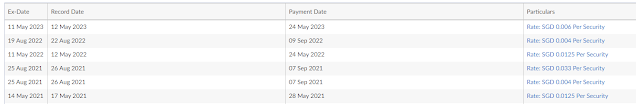

3. Close to 50% cut in dividends as well as changing to a cheaper auditor Baker Tilly relative to KPMG LLP

The May 2023 dividend payout has been cut drastically by the management. This seems to imply that either the Company is losing sales of existing customer fast or that its cost control is inadequate to address further potential decline in its business.

I also do not like the part that Fu Yu made a cryptic statement that its "board and audit committee believe that it is timely to change auditor (KPMG LLP) for the forthcoming financial year ending 31 Dec 2023 considering that it is an opportune time to benchmark the audit fees and realise cost efficiencies". To put it bluntly, Fu Yu is desperate enough to do cost cutting by doing away with the Big 4 audit firm and instead uses a small mid-size audit firm (Baker Tilly). I would not be too worried if they had instead change to any of the other three Big 4 audit firms (it is the hard truth that the best talent in public accounting are in the Big 4 audit firms) but by such a move, this seems to be insinuating that Fu Yu management are troubled by their firm's future business performance.

Parting thoughts

While I was initially excited at the venture into precision medical devices manufacturing as well as the unleashing of the upcoming newly built SMART factory in Singapore, my optimism for Fu Yu under its new management has eroded. I sensed that something is not going well with the current business as well as its future outlook with the above events occurring hence I am selling off most of my stakes in Fu Yu Corp and re-investing the proceeds into a SGX listed blue chip company that is similarly undergoing a business transformation that I have more conviction under a proven management team.

I was excited by the numbers at FUYU in 2022 initially. However their job interview process totally shocked me. Asked me for a write up on April 13 with a deadline of 3 working days which i submitted. Then they replied on 10 May and the interview did not have any questions related to the Corporate Development Analyst role i applied for neither any reference to the assessment which is related to evaluating companies that has synergy to Fuyu's business.

ReplyDeleteHi zzxbzz, interesting interview experience at Fu Yu Corp. Sounds like the management does not really know what they wanted in their prospective new hire.

DeleteI still like their strong balance sheet flushed with cash and the upcoming rolling out of “new state of the art” manufacturing capabilities in their new SG redeveloped site thus still retaining some shares. Saying that, as alluded to the above points, I am having some serious doubts about how their new management team is going to drive the revenue related to their main manufacturing principal activities. All the marketing talks on new bio medical shift seems to be pointing to an upcoming disruption in their traditional manufacturing clientele.