The net assets value went up mostly due to the dividends of S$19K received over the past month from the investment portfolio along with some slight recovery in the overall markets. The Ukraine-Russo war is here to stay and so is the battle against inflation by US Federal Reserve via the raising of interest rates. Singapore banks strangely rallied during the last week of April'22 in spite of the drop of around 10% in earnings.

1. Portfolio 1- Stocks held in SGX Central Depository

This portfolio is designed to provide immediate dividends for use (if required) as it is under my own CDP account and the dividends credited goes directly to my bank account. Going forward, I will be concentrating resources to increase the quantum here as my other Portfolio 2- Margin Purchased Securities (please see section 2 below) has grown to a sufficient scale to sustain itself and also to repay annual financing charges as well as to gradually pay down the margin loan through dividends generated.

No major changes here except for the rights subscription to Lendlease Global Commercial Trust ("LREIT"). I managed to get 11,500 units (inclusive of all my excess application). I saw someone posted that the DPU will drop due to the low pricing of the rights to 5.8% yield. However, my own computation is a 6.2% to 6.5% yield post JEM acquisition- we should see the numbers from the upcoming quarter ending 30 June 2022. Please see below posts:

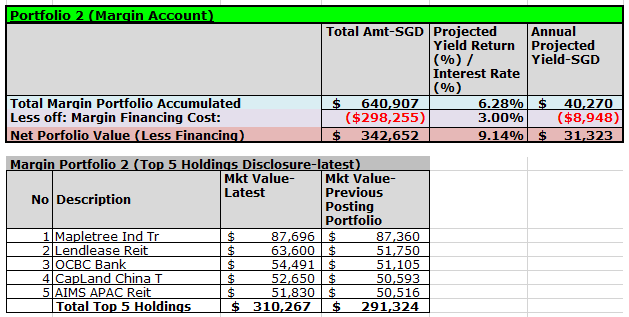

2. Portfolio 2- Margin purchased securities

As mentioned above, my Margin Purchased Securities has grown to a sufficient scale to sustain itself and also to repay annual financing charges as well as to gradually pay down the margin loan through dividends generated. It is currently having a projected dividend distribution yield of 9.14% on S$342,652 of capital being deployed into this portfolio.

Basically, 3 updates here for the past 2 months and all related to LREIT:

(i) purchased additional 10,000 units of LREIT before the rights issue when its price keep dropping;

(ii) subscribed for LREIT rights of 20,300 units and excess of 9,700 units using leverage.

(iii) sold off 20,000 units after the rights issue to reduced concentration risk

I was surprised then that I got all the 30,000 LREIT units that I requested as it was reported that the retail tranche was 1.5 times oversubscribed. I have to sell off 20,000 units immediately in order to reduce my overall concentration risk as I found myself holding on to too many units (if I include in the 40K units under my Portfolio 1). Also took opportunity to take some immediate profit off LREIT.

One important point taken from past lessons is that one should only deal with well-known and established companies for any purchases under margin account in order to mitigate going concern risk of the investments under management. Riskier ventures should preferably be parked under Portfolio 3.

3. Portfolio 3 (with Tiger Brokers)- Venture into higher risk as well as capital growth stocks here

I have sold off all my Alibaba (except for 100 shares being retained) at HKD100 on 8th March 2022. Recently, I have bought back 200 shares at HKD 86.4

3(ii) Lion-OCBC Sec HSTECH (S$)

Between 17 March 2022 to 30 March 2022, I have accumulated 3,700 units here. I still think that China tech stocks offer very good value for money. However, the regulation by the Chinese government on their Tech Sector creates much uncertainty- so I decided to buy into this fund to seek diversification.

3(iii) Dasin Retail Trust

I have sold off 32,000 units @ $0.315 per unit on 22 March 2022. The syndicated loan has not been renewed as 15% of the lenders are making noise. There is an upcoming deal with regard to the asset sales of 2 shopping malls from Dasin Retail. High risk of suspension for Dasin Retail if bankers announced default of loan.

(a) Dasin Retail Trust 15.4% Distribution Yield Per Annum- Typical Value Trap Or A Hidden Gem?-12th March 2022

(b) Dasin Retail Trust Unable To Renew Syndicated Bank Loans For Long Term- Forced to Sell 2 Shopping Malls in Guangdong Province-21st March 2022

3(iv) United Hamsphire REIT-USD

I think that United Hamsphire US REIT is undervalued tremendously-pls see my previous post here. Hence added 11,800 units on 24 March 2022.

Parting Thoughts

The recent news that the Chinese Communist Party ("CCP") will stop clamping down on its Tech Sector is certainly good. Hopefully, it is not too late for the CCP to salvage their battered economy which is facing headwind from the potential collapse of its Property sector as well as Tech sector.

No comments:

Post a Comment