Unitholders still holding on to First REIT got hit with a double whammy shock today (28 Dec 2020) when the REIT Manager announced a rights issue on top of the previous released of rental restructuring of all hospital contracts news the previous month (29 Nov 2020). The sponsors of First REIT wasted no time to twist the knife further into the hearts of all retail unitholders by announcing a rights issue at more than 50% discount off the last traded price of S$ 0.405 per unit on 24 Dec 2020. The price of S$0.20 per unit is also 60% off the projected NAV of S$0.51 per unit after the rental restructuring. Investors who do not subscribe to the rights issue will be severely diluted by this latest move, which to me personally, is a massive destruction of value for all unit-holders. Right after this latest announcement (even before the EGM approval), the price of First REIT went down by a whopping 33% to trade between S$0.26 to S$0.27 per unit.

|

| Potential Consequences of a Sponsor Default |

|

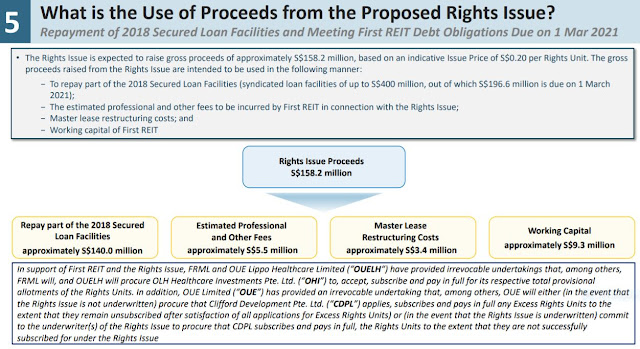

| S$140Mil from the 20cents Rights Issue To Repay Loan Facilities |

|

| Financial Effects Of Proposed Corporate Actions |

There are 3 main questions that both the Sponsors (Lippo Karawaci and OUE Healthcare) and their REIT manager need to answer:

1. Why is the potential breach of bank covenants not previously highlighted prominently in the rental restructuring agreement with Lippo Karawaci on 29 Nov 2020?

My own thoughts on this is that the management is taking way too long to announce this. They should have analyzed and released such pertinent financial information on 29 Nov 2020 during the rental restructuring agreement and organized a townhall with all unitholders to brainstorm instead of adopting such high handed manner in the short time frame to the upcoming EGM.

In addition, using proceeds of rights issue to repay part of expiring bank loans means that the REIT is unable to leverage on the lower cost of borrowings to finance itself. This is detrimental to the entire business and investors and I am surprised that this vital information is not released earlier in the announced rental restructuring proposal as well as the potential rights issue which would have reduced the NAV further from S$0.51 per unit to S$0.36 per unit.

2. Why is the rights issue not priced at 25% or 30% discount instead to last 45 days trading average and the sponsors & REIT manager took such a drastic haircut of 50% for additional rights issue?

The projected NAV is S$0.51 per unit after the rental restructuring agreement. The rights issue represents a 60% discount to projected NAV and a 50% discount to last traded market price. This seems like hitting retail investors below the belt to buy-over unsubscribed rights issuance units at a massive discount and is extremely prejudicial to retail investors who either do not have cash on hand to subscribe for it or who do not want to undertake additional risk in their investments into First REIT.

3. Why not sell some of the hospital properties back to Lippo Karawaci or other potential buyers to raise proceed for loan repayment instead of proposing such dilutive rights issue corporate action?

My personal thought is that Lippo Karawaci should be the one to do a rights issue to fund their own operations instead of downloading all cashflow problems to the investors of First REIT. If they refused to buy their own hospitals based on the latest fair valuation report, then First REIT should sell it off to rival competitors by launching a public tender or asking Siloam hospitals to get ready to exit their operations. As alluded to point 2 above, the heavily discounted rights issue is a heavy handed way to deal with retail investors.

Parting thoughts

Personally, I think that this is an exploitation of retail investors. This seems like a deal that is more beneficial to Lippo Karawaci. The sponsors are holding on to retail investors by their neck. I would rather choose to liquidate the entire First REIT to scare off the sponsors into offering something better value for money instead of trying to milk the existing retail investors dry.

Personally, I think that this is an exploitation of retail investors. This seems like a deal that is more beneficial to Lippo Karawaci. The sponsors are holding on to retail investors by their neck. I would rather choose to liquidate the entire First REIT to scare off the sponsors into offering something better value for money instead of trying to milk the existing retail investors dry.

Ultimately, Lippo Karawaci will the one that gets the most damage if there is a default in paying of rent to First REIT, across all their businesses. Based on the valuation report of the investment properties netting off liabilities after the proposed restructuring agreements, the NAV is S$0.51 per unit. It thus makes sense to just go for liquidation unless Lippo Karawaci offers a better deal rather than letting the share price drop to S$0.26-S$0.27 with the detrimental rights issue proposal. Lippo Karawaci should come back with a better deal for retail investors instead of taking the easy way out.

Last but not least, my other personal thought is that breaking lease agreements once means that the senior management of Lippo Karawaci group will simply repeat the same act of default and another rights issue again if there is another economic crisis. Toss a coin Head or Tail but Lippo Karawaci wins either way....strange isn't it?

(P.S: Please also see my last posting on First REIT below

Lippo Karawaci's management practices are horrible and for sure there will be lawsuits coming... My personal bet is that FIRST REIT will default

ReplyDeleteI hope Lippo will default and then First Reit sue Lippo as they have the contract to shield them. I already screwed First Reit's manager why they didn't sue Lippo since there is a contract while they only said "they were not informed" in June 2020. See now what happens? FR can't even save themselves still got cheek to use unitholders funds aka dividends to do charity and give 4 months of rental rebates. This FR's manager also super idiotic.

DeleteINDEED A DEFAULT WOULD BE A MUCH BETTER OUTCOME FOR RETAIL INVESTORS THEN THE CURRENT 26 CENTS...WILL DEFINITELY REJECT...

DeleteTotally agreed with you on all the points. I have significant amount of shares of FR, but not my most holdings. I have sent numerous emails to screw FR's manager but to no avail. I told them in June 2020 if they continue to let the stock price slide, they won't be able to loan any money and will be forces to sell their asset. Seems like this FR manager is useless and most probably his staffs are not cursing and swearing at him. FYI, I'll be sending my hardcopy proxy form to vote against both resolutions and hope that the rest will do so too. I don't mind FR go into default cause they will have to think of ways to safe FR and not always milk the unitholders dry. If FR were to sue Lippo when they first announced their intent to default, this whole situation will be much rosier for FR now.

ReplyDeleteHi Whis Key, logically speaking, I think most retail investors will reject this rescue plan as it does not make sense from a mathematical perspective.

DeleteHowever saying that, another group of retail investors will be worried that if there is a default in rental payment by Lippo Karawaci and bank covenants are breached, it will lead to an immediate call on repayment of bank loans and an immediate long term suspension by SGX and their funds will be freezed.

Existing shareholders (as part of their rights as owners) can raise motion for alternative plan such as agreeing to the restructuring agreement but getting Lippo Karawaci to top S$150Mil bank loan repayment to sweeten the deal.

Unitholders can also ask for another EGM or at AGM and raise a motion to pursue legal action for rental default by the sponsor to put pressure on them to do their own rights issue to abide by contract law on rental commitments. Just write in to the Company Secretary instead of the REIT Manager. However, best to negotiate through the REIT Manager for a win win solution with the sponsor.

What action will SGX takes in view of the many breaches by FR Management??

ReplyDeleteHi Unknown, currently there does not seemed to be any breach of statutory act or SGX rules that was announced. The only grey area is in the fair valuation of the investment properties which is subjective in the context of the Indonesia political and market sentiment & also whether is assessed only on a going concern basis.

DeleteI am VOTING AGAINST THE ISSUE OF RIGHTS, LET the SPONSOR GET ALL THE RIGHTS THEMSELVES. THEY GET THEIR BIG FAT PAYCHECK, WE GET NOTHING

ReplyDeleteAS THE WORLDS SAYS THE RICH ARE OUT TO MILK OUT THE SUCKERS. I AM NOT . LET FIRST REIT GETS LIQUIDATED . HUAT

ReplyDeleteMANY THANKS BLADE KNIGHT FOR THE VERY GOOD ARTICLE,

ReplyDeleteANY IDEA WHAT WOULD BE THE OUTCOME FOR RETAIL INVESTORS IN CASE OF DEFAULT ? IT SEEMS THAT FR ASSETS VALUATION IS 1.3B FOR 560M DEBT ?

Hi Unknown, in the event of known default, this will breach the loan covenant and triggered an immediate recall of bank loans by the bankers. SGX will also agreed to an immediate suspension in trading on SGX to protect all unitholders while First REIT Manager raced to find an alternative solution.

DeleteRetail investors will find their residual funds tied down with no exit option until the SGX suspension is lifted with a viable re-financing solution or till liquidation completed.

This is a double edged sword that will force Lippo Karawaci to up the offer or do rights issue on its own to save its entire business operations in Indonesia as a default of payment will immediately lead to a rating downgrade by credit agency and may also affect investors and customers confidence but note that retail investors may run the risk of getting nothing back even in the event of liquidation.

I am not sure how much are the hospital assets worth given the political situation in Indonesia and will give a pinch of salt to the latest valuation report.

once rogue, always rogue. Ppl here seem don't understand the meaning of bad reputation history of Riady family.... Just stay away from any Riady names, seriously! If you continue to look at numbers or terms but fail to look into this from a more macro perspective, u r doomed

ReplyDeleteHi everyone, I am unfortunately paying for this rookie mistake of holding on to first reit and waiting for a turnaround.

ReplyDeleteI am now sitting on a 60% unrealized loss...what should I do? Cut my losses now?

Hi MyCorner, I am in the same position as you, sitting on a 70% unrealised loss although my overall position in FR is small. I am now abit conflicted on what should i do? If all of us vote no to the resolutions and a EOD happens, what will happen to us retail investors?

ReplyDeleteAs Blade Knight correctly mentioned, I still don't understand why they are not selling some of their assets to pay the 2021 debt....hopefully this could happen if we vote no to the resolution.

ReplyDeleteI have 31500 shares in First Reit with 75% net loss. Please let me know if this makes sense to go with the ride of downs or liquidate and get whatever is left?

ReplyDeleteHi Atypical Girl, there is no right or wrong decision here as there are just too many variables for consideration. Best is to attend the Unit-holders and Mgt Virtual Dialogue session to be moderated by SIAS held on 7th Jan 2021 (5pm-6pm). Hear from the Management directly and then listen to the questions and concerns raised by the unitholders also to make an informed decision.

ReplyDeleteBtw, valuation normally follows some (i)mathematical model such as Discounted Cashflow or (ii)comparison to similar recent market transaction to determine concept of value. So the fair value of the investment properties determined for First REIT seems to be using method (i). Hence in the event of liquidation, there may be a remote possibility of no other buyer appearing. Indonesia working dynamics is not like Singapore and depends on the "powerful" people you know and the rules are grey when it comes to whether the government officials will just allow hospitals to be sold off like that. This can mean the investment properties are entirely worthless if it comes to the liquidation stage if one takes Lippo Karawaci out of the picture totally.

I guess it is a situation of who blinks first. If really default, Lippo Karawaci will suffer great damage to its reputation and its other businesses in Indonesia may collapse hence they will be forced to raise cash to honour their First REIT commitment or alternatively, Lippo Karawaci may decide to just throw in the towel and really go ahead with the default and challenge unit-holders to face the consequences and possibility that the investment properties value will plunge to zero in such event as aforesaid mentioned.

The ideal win win case would be Unit-holders try to get Lippo Karawaci to raise S$150 Million themselves on goodwill to pay off the portion of loan that cannot be renewed and call off the rights issue. Ultimately, the new restructured rental agreement (if accepted by Unit-holders) would give rise to savings of S$30Mil in base rent every year- hence absorbing S$150Mil at their side seems to be fair for all parties