The stock market continued its horrendous game of Yo-yo with the US Federal Reserve threatening more interest rate hikes and the stock market tanked with the news earlier this week. Even the bond market is not spared. So buy equities or buy bonds one will still get whacked hard these days. September 2023 has been a good month as I finally received dividends payout of S$19K which I used to invest in Keppel Corp and also to purchase more balanced funds from Endowus platform. Overall, net asset value stands at S$551K and a projected passive income of S$51K as at 29 September 2023.

(Note: Please also refer to my other Family Portfolio which is projected to yield +S$20K of passive income per annum).

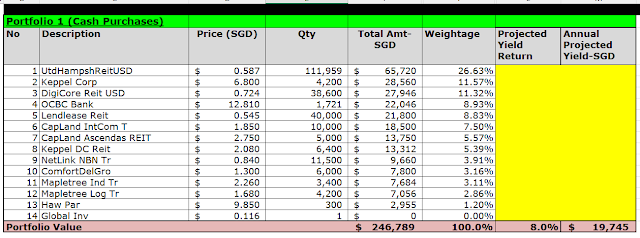

1. Portfolio 1- Stocks held in SGX Central Depository

(Note: This portfolio is designed to provide immediate dividends for use as it is under my own CDP account and the dividends credited goes directly to my bank account.)

I have continued investing into Keppel Corp when its prices fall to S$6.75 per share. The much anticipated EGM for Keppel Corp has been announced and it will be held in October 2023. Special dividends in the form of Keppel Office REIT units will be given to existing shareholders once it is approved by shareholders.

2. Portfolio 2- Margin purchased securities

(Note: My margin purchased securities has grown to a sufficient scale to sustain itself and can pay off annual financing charges as well as to gradually pay down the margin loan through dividends generated.)

(a) I have earlier sold off all my investments in Manulife US REIT ("MUST") in late July 2023 and re-invested the proceeds into Keppel Oak US REIT. No choice but to bite the bullet as MUST is unable to pay out dividends due to a breach of bank covenant and it seems that MUST is entering into its final death spiral;

(b) Additional purchase of 5,000 units of Mapletree Industrial Trust at S$2.22 per unit on 7 August 2023;

(c) Also bought into additional 1,000 shares of OCBC at S$12.22 per share on 22 August 2023 as I think that its management strategy of focusing on growing its wealth management business will enable OCBC to do well for its future;

(d) I have also paid off S$8K of margin loan using dividends received in September 2023 to reduce interest expenses and also leverage ratio.

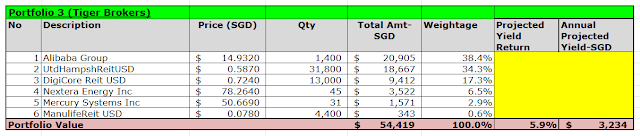

3. Portfolio 3 (with Tiger Brokers)- Venture into higher risk as well as capital growth stocks here

(i) Sold off all my DigiCore REIT to take profit at US$0.575 per unit. Have bought back 13,000 units when its price began to drop;

(ii) Despite the Manulife US REIT financial woes due to downturn of US Commercial office sector, I have re-entered into this REIT for speculative purpose over 2 tranches at US$0.60 per unit and US$0.45 per unit. Anyway, this is just a tiny stake to earn some spare change for a buffet dinner in the event that MUST management managed to save it. This also reminds me of Barista Fire's recent rather interesting posting on gambling mindset "When Investing Becomes A Dangerous Mistake" ;

(iii) Have also purchased small stakes in US Utility provider Nextera Energy when its price dropped steeply. Also entered into Mercury Systems Inc in US market. Mercury is in the defence technology and equipment sector.

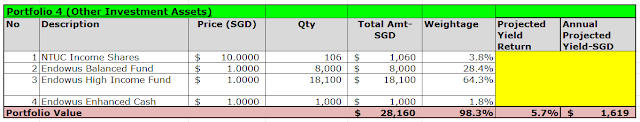

4. Portfolio 4 (Endowus & Other Investments)

(a) I have began investing into the Higher Income Endowus fund that seeks to pay out passive income of 5.5% to 6.5% per annum. This is a combined funds portfolio that is 20% equities and 80% into bonds and recommended by Endowus.

(b) Have also been adding on to the Balanced Fund that I self-created using PIMCO GIS Income Fund, Allianz Global High Yield and Fidelity Global Dividend Fund.

Summary

I have began building up more exposure to bonds using Endowus balanced funds to further diversify away from my excessive exposure into equities. I believe that bond funds should benefit from capital appreciation next year once the interest rates are being cut by the US Federal Reserve.

Wow 10% return. I am only at 6%.

ReplyDeleteHi YX, there are unrealised capital losses due to the market downturn (I do not intend to illustrate this part as I am more passive income driven investing approach -so long as the invested business/financial instruments don't enter into bankruptcy and continue to churn out dividends and interest income).

ReplyDeleteAlso I do have higher risk with the employment of the use of margin financing (which is a double edged sword).