The lightning speed of the announcement this week by Keppel Corp on the acquisition of Singapore Press Holdings Group ("SPH") caught many folks by surprise. Although I have mentioned on my 25 July 2021 post that corporate actions for SPH should eventually come as "it is an inevitable eventuality given the benefits of economies of scale", the sudden materialization of corporate action still have me reeling in surprise and my jaw dropping. Are we finally bidding a last farewell to SPH which was incorporated on 4th August 1984? Is the offer of S$2.2 billion enough to convince existing Keppel Corp and SPH shareholders to say "yes" to the deal?

1. S$2.2 billion offer by Keppel Corp is a very good deal?

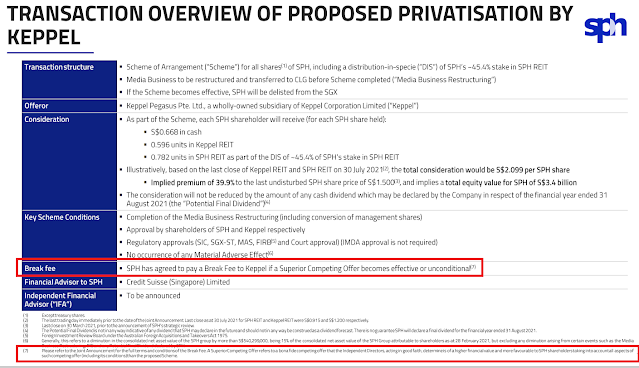

Unfortunately, the answer to this is a big "No No" as evident in the current market pricing of SPH which nowhere cross the S$2.099 mark as well as the drop in the price of Keppel Corp, Keppel office REIT and SPH retail REIT. The offer sucks in a big way as it is not wholly cash being offered. Instead close to two-third of the offer is being offered via a distribution in specie with units of Keppel REIT and SPH REIT to buyout existing SPH shareholders. This is in some way similar to the current Capitaland restructuring deal.

Unfortunately, the answer to this is a big "No No" as evident in the current market pricing of SPH which nowhere cross the S$2.099 mark as well as the drop in the price of Keppel Corp, Keppel office REIT and SPH retail REIT. The offer sucks in a big way as it is not wholly cash being offered. Instead close to two-third of the offer is being offered via a distribution in specie with units of Keppel REIT and SPH REIT to buyout existing SPH shareholders. This is in some way similar to the current Capitaland restructuring deal.

|

| Screenshot 1: Market Valuation of SPH Deal |

Hence the extremely bad point of the deal is that the Keppel buyout is dependent on the market price of Keppel REIT and SPH REIT and if both REIT dropped in valuation, the SPH deal will be valued less. For instance, in an extreme scenario that if there is a new mutant Echo Variant COVID-19 that renders vaccine totally useless and forced another circuit breaker, Keppel REIT and in particularly, SPH REIT, might plummet in market value.

As per screenshot 1, the current market valuation on offer has dropped to S$2.041 per share from the original announced package of S$2.099 per share as at 6th August 2021. Also it is interesting to note that SPH market price is trading at S$1.90 per share as at 6th August 2021 and 7.44% away from the new valuation of S$2.041 per share.

2. Why is there a material deviation of 7.44% between the market valuation of S$2.041 and the last traded price of S$1.90 per share?

The reason for this is simple as the Keppel offer still has much grave uncertainties. There are 3 main hurdles to clear before the deal is concluded:

|

| Screenshot 2: Timeline of Completion of Keppel Offer |

(a) More than 50% approval of SPH shareholders need to be obtained for restructuring of Media business segment into the newly formed CLG (Company Limited by Guarantee) in September 2021 EGM. The T&C of the Keppel offer lies in that the transfer of Media assets out of SPH is first approved by the shareholders of SPH;

(b) More than 75% special resolution approval by Keppel Corp shareholders to buyout SPH shareholders at S$2.099 per share in November 2021 EGM and

(c) More than 75% special resolution approval by SPH shareholders of the S$2.099 per share offered by Keppel Corp in November 2021 AGM.

3. How likely is the deal to go through?

Well, there are some very angry retail investors out there clamoring for blood and will oppose the deal. This is especially for those long term retail investors holding from S$4 per share era and another group which feels that this is grave undervaluation for SPH net assets- pls see below screenshots from forums.

Well, there are some very angry retail investors out there clamoring for blood and will oppose the deal. This is especially for those long term retail investors holding from S$4 per share era and another group which feels that this is grave undervaluation for SPH net assets- pls see below screenshots from forums.

Personally, for me, my thoughts are that the first part of the scheme requirement, that is, the media business must get transferred out of SPH will definitely go through as it only needs more than 50% of the votes of shareholders. It makes perfect sense to get rid of the loss making business unit from a commercial perspective. After that is done, I thought that there maybe a real possibility of another private equity fund coming to make an offer for the remaining SPH properties to compete with Keppel Corp. The current scheme offered by Keppel Corp contains a breaking fees levied on SPH should another party came along with a better offer.

|

| Screenshot 3: Break fees in event another party made a better offer |

Even if there is no other offer and left with only the Keppel deal, probability of this deal going through will still be very high. Most retail owners who hold small number of shares in SPH and Keppel Corp will probably sit out any voting at EGM due to indifference to corporate governance. Only those few who felt strongly opposed to the scheme will want to come out to vote against it. The buying of shares via custodian accounts held from Saxo, Interactive Broker, Tiger Brokers, DBS Vickers etc also makes it difficult in terms of administrative procedures for retail shareholders to try to attend AGM/EGM. As for the big boys, I have no doubt that these institutions will be voting for a "Yes" as there is much synergy to be gained from an M&A between Keppel Corp and SPH-pls see screenshot 4 below.

Parting Thoughts:

I think that most shareholders will vote for this deal as the downside in not selling will mean that SPH will continue to be run by its current CEO Mr Umbrage. Personally, I would have preferred a SPH CEO with many years of experiences in property development or property management background instead of one with only extensive experiences from the Singapore Armed Forces only (please do not tell me that the current CEO also has much commercial NOL experience-this is irrelevant). Keppel Corp should have many of such talents in its group who can better run SPH. There is thus also much synergy in terms of manpower re-organization.

I think that most shareholders will vote for this deal as the downside in not selling will mean that SPH will continue to be run by its current CEO Mr Umbrage. Personally, I would have preferred a SPH CEO with many years of experiences in property development or property management background instead of one with only extensive experiences from the Singapore Armed Forces only (please do not tell me that the current CEO also has much commercial NOL experience-this is irrelevant). Keppel Corp should have many of such talents in its group who can better run SPH. There is thus also much synergy in terms of manpower re-organization.

(P.S: Note that I have acquired 14,000 shares of SPH recently from S$1.90 to $1.93 range post announcement of the Keppel offer. In the event that a black swan event occurs such that the deal does not proceed, holding on to SPH is still a relatively fair option given that it can still spin off its Student Accommodation Business into a future IPO to realize its intrinsic value. Seletar Mall and Woodleigh Mall can also be sold off into SPH REIT).

No comments:

Post a Comment