The astounding news that the 5th largest tenant of Digital Core REIT ("DCR") has filed for bankruptcy protection in the US sent out shockwaves to many investors out there who believed that Data Centre REITs are super resilient in earnings and with some proclaiming the nature of data centre REIT to be equivalent to government bonds. DCR's unit price which has been gravity defying since its IPO finally dropped below US$1 per unit to an intra-day low of US$0.95 per unit at one point, during market trading on the week of 22 April 2022. Keppel DC REIT itself is also not spared the bloodbath and in fact, its unit price suffered a worst fate than DCR and plummeted to a 52 week low of S$2.060 per unit. What ever happened to these data centres REITs once proudly proclaimed as precious jewels and infallible investments by investors?

1. DCR's trouble with one of its top 5 largest tenant

While DCR's sponsor Digital Realty has guaranteed the cashflow of DCR in the event of any-near term shortfall arising from the tenant (Sungard Availability Services) bankruptcy, this is cold comfort. The invincibility myth of data centre REITs has been dispelled. Rising interest rates impact on bank borrowings and high energy prices posed a double whammy to the future performance of DCR.

The fortunate thing is that investors seem to have recovered from the initial shock and DCR has since recovered to US$0.995 per unit at the end of April 2022 last trading date. Many investors continue to keep faith in DCR and its sponsor.

As for me, I continue to keep my distance away from DCR-please see my last post on this. My issue has always been about the unbelievable extremely low distribution yield of 4.18% and 4.63% expected from DCR at a price of US$1.00 per unit for the 1st year and 2nd year respectively projected during IPO and the US withholding tax risk that makes holding on to it not worthwhile. Not to mention that DCR just IPO and then in record time, we have a major tenant default risk event occurring, this does not bode well for its sponsor's reputation.

Nonetheless, if DCR drops below IPO price of US$0.88, I may decide to re-consider adding some of its units into my current portfolio.

2. Keppel DC REIT nose-dive that shell-shocked many retail investors

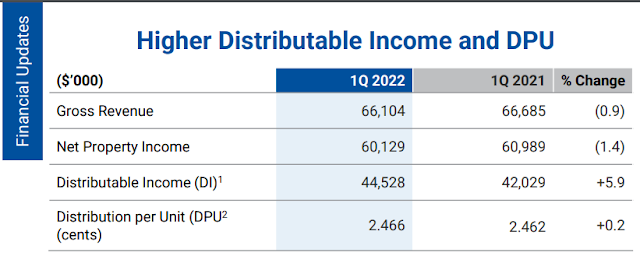

Interestingly, Keppel DC REIT unit price also plunged to a 52 week low of S$2.060 per unit. Despite the many acquisitions done in 2021, its Q1 Gross Revenue dropped by 0.9% and Q1 Net Property Income fell by 1.4% relative to Q1 of prior year. So what exactly happened?

2.1 Current legal dispute with tenant DXC Technology

The current legal tussle with its tenant DXC Technology Services at the Serangoon North Avenue 5 data centre may have casted some shadow over the financial performance of Keppel DC REIT. Many investors were extremely disappointed over the negative revenue growth and Net property Income. But I think that it is prudent for Keppel DC REIT to stop recognizing any recurring disputed rental as well as making a provision for those that were already recognised.2.2 Has the Keppel DC growth story stagnated and will it go below S$2 per unit?

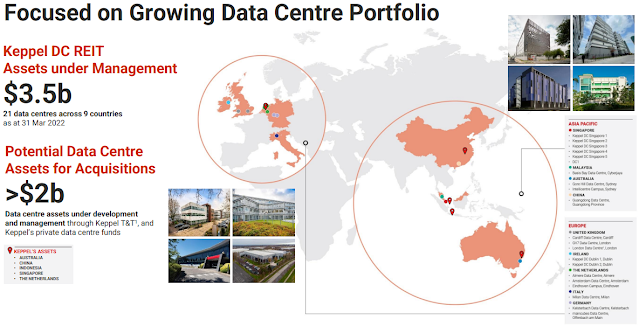

Keppel DC REIT has 21 data centres worth S$3.5b spread across 9 countries as at 31 March 2022. It has a geographically well-diversified portfolio. In addition, in the pipelines are over S$2b worth of potential data centre assets for acquisitions. Furthermore, right of first refusal has been granted for 5 other data centres within the Guangdong Data Centre campus. The future remains extremely bright for Keppel DC REIT.

Personally, I think that Keppel DC REIT is better diversified geographically than DCR as well as having a much higher distribution yield of 4.77% relative to DCR's 4.18% . Hence its current pricing of S$2.070 as at 29 April 2022 seems more attractive relative to DCR. I think that there should be enough support from its future growth story and benchmarking comparative to DCR to prevent further free-fall of its unit's price. It is interesting to note that CGS-CIMB Research analysts are keeping their target price unchanged of S$2.62 per unit.

Parting thoughts

The current headwinds are good for investors to do a self check and also serves to flush out those weaker investors who thought that data centre REITs are invincible, thereby, totally forgetting that data centre REITs are ultimately equity in nature and the associated routine business risks are always present.

No comments:

Post a Comment