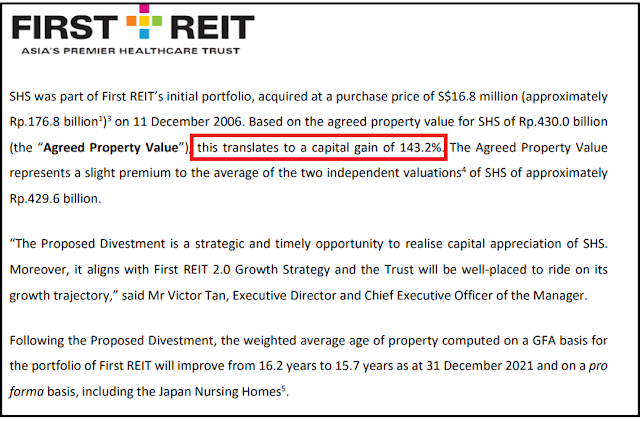

The recent press release by First REIT (on 18th May 2022) with regard to its disposal of Siloam Hospitals Surabaya ("SHS") is mind boggling. First and foremost, the press release talked about the original cost of acquisition of SHS was just S$16.8Mil in 2006 and hence the selling price of S$40.9Mil translates to a huge capital gain of over 143.2%. However, when one opened up the SGX announcement, it revealed a shocking loss of <S$0.6Mil> upon the disposal of SHS. There appears to be 2 completely contradictory statements being made. What exactly is going on here?

1. Press release emphasis on 143.2% gain since initial purchase at S$16.8Mil.

|

| Extract of Press Release |

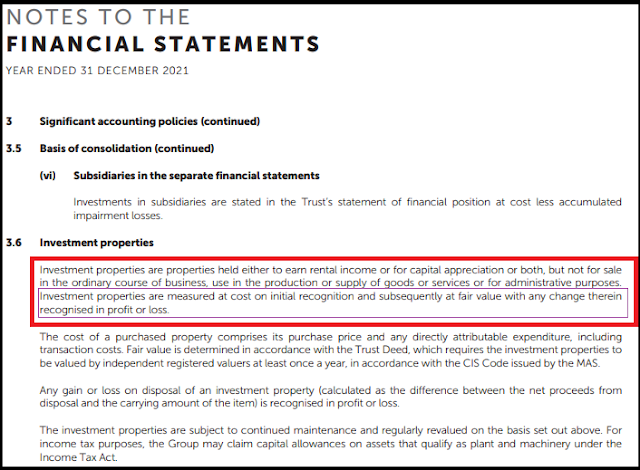

2. Fair valuation of SHS (S$40.9Mil) as at 31 Dec 2021 is already the same as the announced selling price

If we read the annual report, the S$40.9Mil is already the fair valuation in the financial statements of the annual report for the year ending 31 December 2021. |

| Accounting Policy For Fair Value to P&L for Investment Properties |

The accounting policy is clear that any subsequent increase in fair value would have been passed through to the Profit and Loss of First REIT. Hence its market price already factored in this fair valuation gain to S$40.9Mil since this is already captured in their books. Therefore, if the offered sales consideration is also S$40.9Mil, the sales of SHS is actually a loss for First REIT given that there is S$0.6Mil worth of professional service fees and divestment management fees payable to the Manager of First REIT.

3. Loss on proposed disposal of SHS of <S$0.6Mil>

|

| Extract of Announcement On Loss of S$0.6Mil from Proposed Divestment |

As aforesaid mentioned, since the of S$40.9Mil selling price after netting off current book value of S$40.9Mil plus S$0.6Mil of selling cost is negative, this gives rise to a loss upon the proposed divestment.

Parting thoughts

The proposed divestment price is rather disappointing as after 5 months and in-spite of post COVID recovery in Indonesia, the valuation of Siloam Hospitals Surabaya remains the same as the valuation as at 31 December 2021 captured on the books of First REIT. As a matter of fact, this is a loss upon disposal of <S$0.6Mil>. However, all is not bad on this deal.

The proposed divestment price is rather disappointing as after 5 months and in-spite of post COVID recovery in Indonesia, the valuation of Siloam Hospitals Surabaya remains the same as the valuation as at 31 December 2021 captured on the books of First REIT. As a matter of fact, this is a loss upon disposal of <S$0.6Mil>. However, all is not bad on this deal.

With the disposal of Siloam Hospitals Surabaya, it slowly chips away at the over-concentration risk of having one single tenant contributing to a substantial portion of the total rental income. This is currently still the Achilles' heel of First REIT. Many investors/ex-investors paid a huge price for their investments into First REIT during the default of the previous main tenancy agreement which was crafted as a "restructuring" of master tenancy agreement. I do hope that the new 2.0 Growth Strategy will be able to fundamentally make First REIT more resilient and prevent such unfortunate crisis from happening again and all the best for current investors still holding on to First REIT.

P.S: Please also see my other postings on First REIT below

No comments:

Post a Comment