Recent good news is that Jerome Powell seems to be done with his interest rate hikes to combat inflation and that we are nearing the peak interest rate cycle. As a result, most of the REITs rallied in prices due to better outlook. I have continued to put down additional funds into United Hampshire US REIT, Frasers Logistics & Commercial Trust as well as purchase of bonds (via Endowus). Dividends received for quarter 3 were also utilised to pay down my margin loan given the high interest rate environment. Perhaps the most interesting event was the Keppel REIT units being given out by Keppel Corp which I have retained.

(Note: Please also refer to my other Family Portfolio which is projected to yield +S$20K of passive income per annum).

1. Portfolio 1- Stocks held in SGX Central Depository

(Note: This portfolio is designed to provide immediate dividends for use as it is under my own CDP account and the dividends credited goes directly to my bank account.)

2. Portfolio 2- Margin purchased securities

(Note: My margin purchased securities has grown to a sufficient scale to sustain itself and can pay off annual financing charges as well as to gradually pay down the margin loan through dividends generated.)

Dividends received were used to pay down the margin loan. I have also invested into Frasers Logistics and Commercial Trust as its unit price has plummeted over the past few months.3. Portfolio 3 (with Tiger Brokers)- Venture into higher risk as well as capital growth stocks here

Earlier on 8th November 2023, I sell off all of my units in Manulife US REIT ("MUST") and took profit of 50%+ in my small stake speculation. Then on 30 Nov 2023, MUST price crashed 50% after the announcement of a rescue package with loan-shark loan and I took the opportunity to re-initiate a small position in MUST again with different tranches between US$0.56 to US$0.66. This is pure speculation as chances of firesales of its assets are quite high with possibility that unit-holders will get back none of their money.

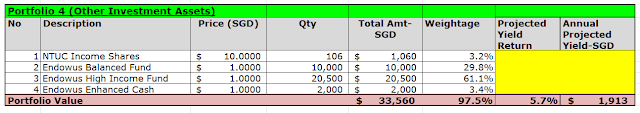

4. Portfolio 4 (Endowus & Other Investments)

(a) I have continued adding into the Higher Income Endowus fund that seeks to pay out passive income of 5.5% to 6.5% per annum. This is a combined funds portfolio that is 20% equities and 80% into bonds and recommended by Endowus.

(b) Have also been adding on to the Balanced Fund that I self-created using PIMCO GIS Income Fund, Allianz Global High Yield and Fidelity Global Dividend Fund.

Summary

The camp between stock bull market rally in 2024 while the others asserted that a global recession is imminent does cause a bit of a headache in terms of allocation of investment funds. I am adopting a conservative approach with more of my investments going into bond funds via Endowus and also paying down the margin loan.

No comments:

Post a Comment