Hi Folks, in my previous post on why things are not so rosy as it seems with Keppel DC, I have mentioned why I think that KDC is overpriced even with a 4.43% distribution yield even after the major acquisitions of 2 data centres at Genting Lane from its sponsor. Interestingly, I think that investors is viewing KDC as a “mini” growth stock rather than a REIT. The belief in more of such future acquisitions might be the only plausible explanation on the market premium over its net book value and current super low distribution yield.

Anyway, for those retail investors who are interested in the preferential offer, please take note of the below key dates so that you don’t miss it:

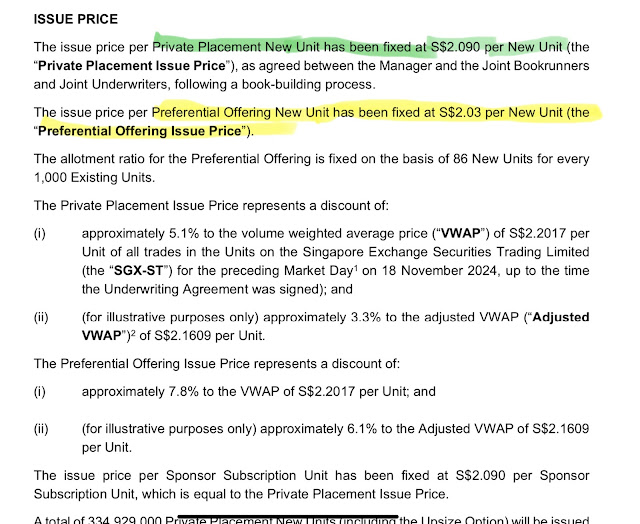

Pricing has been set at S$2.03 per unit. Every existing retail investor will be entitled to 86 new units for every 1,000 units held.

Parting Thoughts

Since the market trading price as at 29 November 2024 (Friday) is still at a strong S$2.220 per unit and the preferential offering is at S$2.03 per unit, there is approximately 10% profit for those who managed to find ways to oversubscribe & gets allotted extra units. Selling these extra units off on 18th December 2024 will then become a tidy profit within a short 2 weeks trade, assuming that the market price remains strong at current level. Of course, if price were to tank after the preferential offerings, then one has to eat grass. :)

No comments:

Post a Comment