Overall Outlook

Retail REITs bounced back strongly with the announcement of allowing dining for 2 at F&B outlets and Singapore targeted vaccination rate of 67% by National Day (9th Aug'21) which will bring us closer to herd immunity and avoid future lockdowns. The confirmation of delivery of new supplies by Pfizer and Moderna are great news indeed for our national inoculation programme.

Both SPH REIT and Lendlease REIT are now at an all time high since the COVID-19 outbreak. In addition, SPH REIT and Lendlease REIT are among some of the potential list of Singapore REITs to be included in the FTSE EPRA NAREIT which will no doubt boost allocation by international fund managers into them hence an increased in their demand.

1. Portfolio 1- CDP held stocks

I made a rather silly blunder here. I was using my own CPF funds to invest into Mapletree Industrial Trust ("MIT") but forgot that there is cap on the amount that can be used. Under the CPFIS-OA, you can only invest up to 35% and 10% of your investible savings in stock and gold respectively, also known as the CPFIS stock and gold limits. As a result, 700 MIT units need to be paid for in cash. The other 200 I got it from the recent rights issue of MIT.

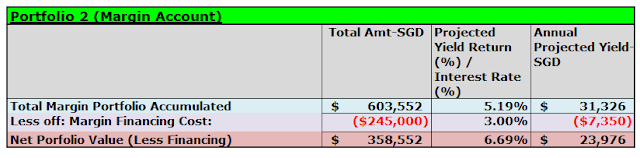

2. Portfolio 2- Margin purchased securities

Not much changes here except for taking up rights issue of MIT and also accumulating Ascendas REIT when its price drop below S$2.94. Ascendas REIT went on a buying spree recently to increase its high-tech data centers properties as part of its new strategy going forward.

Prime US REIT also went on an acquisition exercise recently via a private placement. This new office acquisition is expected to be yield accretive.

3. Portfolio 3 (with Tiger Brokers)- Venture into higher risk as well as capital growth stocks here

I bought a small number of Alibaba Group stocks here when its price dropped below HKD220 per share. I think its cloud computing services will continue to grow on top of its e-commerce platform business.

I also started re-investing into SingMedical Group. Its Vietnam clinics are expected to perform well. Not sure why SingMedical PE ratio remains so much lower compared to other medical groups. Recently, there was talk of corporate action with a 3rd party to purchase the shares of SingMedical. Unfortunately, it did not materialise and price dropped from S$0.415 in Feb'21 to S$0.305 as at 2nd July'21. Problem with holding on to SingMedical shares is that its share price can be stuck in doldrums for many years.

I have also acquired more shares in Oceanus Group. I find their business intriguing- please refer to the previous Oceanus post here.

Parting thoughts

Many of the above companies will be reporting their half year results soon and I am looking forward to the half yearly dividends payout over the next 2-3mths. My overall strategy is still an income focused one while diverting some resources into capital growth stocks.

(P.S: Please also refer to my previous posting on the hidden danger of using online brokers such as Interactive Brokers, Saxo or Tiger Brokers.)

No comments:

Post a Comment