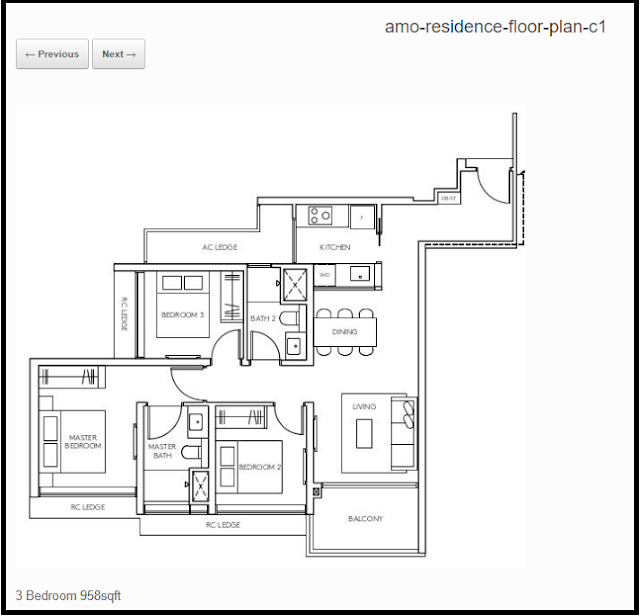

AMO Residence located off Ang Mo Kio Avenue 1 ended the weekend of 23 July 2022 with 98.1% of its 372 units all sold out. The average price of units sold is at incredulous S$2,100psf. What a crazy price for Ang Mo Kio. UOL Group and its partners are now laughing all the way to the bank. I can still remember back in 2010 when Centro Residences debuted at Ang Mo Kio Centre- it was going for an eye popping S$1,200 psf by Far East Organization during launch and many people were saying that is so exorbitant and a record price of over the psychological barrier of up to S$1,000 psf for sub-urban area. Well, 12 years later, prices for new launch condo at Ang Mo Kio now apparently hit S$2,100 psf. This is paying close to S$2Mil for a compact 958 sqft 3 bedder unit.

Using a loan of S$1.5Mil spread over 30 years for a young couple along and assuming a 2.5% interest rate, this will mean a monthly payment of S$5.9K which means each husband and wife need to cough up around S$3K individually each month to service their mortgage. Total interest paid over 30 years will add up to S$634K.

If interest rate continues to increase to say 3.0%, it will mean a monthly servicing of S$6.3K per month. Total interest rate paid over 30 years will be S$777K- I think it is time to buy more shares of DBS, UOB and OCBC listed on SGX which seems to be a better investment.

|

| 3.0% borrowing rate simulation |

Well, such pricing is not for the faint hearted folks. Down payment and stamp duties will mean half a million upfront in cash and CPF and not to mention in the current climate of rising bank borrowing rates, it certainly takes great courage to sign the option to purchase. According to property agents, the success of AMO Residence shows that "the market is hungry for attractively priced homes in good locations". Property prices is still a good hedge against inflation according to many people. I am not sure on that. However, I do hope that job losses are kept to a minimum in the upcoming economic downturn and everyone gets to keep their bread and butter. Else it will be extremely painful to support a S$6K per month mortgage.

No comments:

Post a Comment