Aztech is back again with a new IPO of its "Internet of Things ("IoT") & Data Communication products, LED lighting products and Kitchen appliances electronic manufacturing business this time. Why did I use "back again"? Well, Aztech was previously listed on the SGX before getting privatized in a not too fantastic deal on 20 September 2016. Aztech's share price had fallen drastically from S$1 per share in May 2015 to S$0.32 per share on 16 September 2016. The Aztech Group was then subsequently taken private with the co-founder and CEO offering a S$0.42 per share. I have a personal bad feel about management buying out retail investors at a low price and then repackaging a few years later to come back with an IPO at S$1.20 per share. What if the same tragedy happens again?

I will just do a quick sum up of my personal thoughts on why I am avoiding Aztech Global Ltd:

1. Aztech Global has disclosed the key business risk that its manufacturing facility in Dongguan do not have the necessary certification in right of use which may lead to disruption in supply and also potential breach of contract for late delivery due to the potential disruption.

Wow, this is an extremely risky event and a bad omen to kick off the IPO with no better certainty. Shouldn't Aztech Global delay the IPO till this issue has been settled? They seemed desperate to launch the IPO to raise funds.

Wow, this is an extremely risky event and a bad omen to kick off the IPO with no better certainty. Shouldn't Aztech Global delay the IPO till this issue has been settled? They seemed desperate to launch the IPO to raise funds.

2. Risk of Illiquid Shares- Deja Vu of what happened in the previous Aztech Group version.

There is a possibility that even if one wanted to sell the stocks, there will not be sufficient buyers just like the good old days a few years back in another listed company called Aztech Group before it was privatized cheaply.

3. Strange low NTA of S$0.2598 per share post IPO share capital of 773,720,000 shares relative to IPO asking price of S$1.20 per share.

This is the weird part. Aztech Global's NTA per share is only S$0.2598 relative to IPO price of S$1.28 per share. In the case of immediate liquidation, it's a huge drop in recoverable amount. I am unable to ascertain whether this was due to investment property at historical issue and not marked up to fair market valuation.

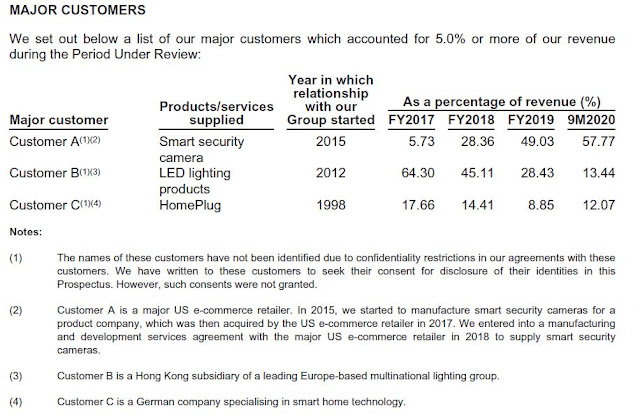

4. Customer concentration risk and unknown customers to assess quality of clients and potential bad debt

The customers here are very secretive. While this is fine due to commercial and operational rationale, it does not appear transparent or informative for assessment on credit risk especially when these 3 top customers made up such a huge chunk of Aztech Global's revenue generation.

5. Kay Lee Roast Meat acquisition did not workout in 2014- From Targeted 10 Kay Lee Restaurants to only 1 outlet

Aztech used to venture into F&B businesses. It made headlines in 2014 when it bought over the secret recipe of their roast meat and premises from Ha Wai Kay and Betty Kong for a whopping S$4Mil. The biggest Kay Lee restaurant opened in Suntec City which could seat 100 diners anytime. However, all Kay Lee Restaurants had since folded with only the original one at Upper Paya Lebar Road.

Now you may ask what has roast meat got to do with this IPO being good or not? Well, my personal thoughts are that it does matter. It depicted the track record of building up a new business by the Aztech management team.

Parting Thoughts:

The Aztech Global new IPO will cut off by 12pm, 10 March 2021. Based on the above, I will be staying far far away from this IPO.

The Aztech Global new IPO will cut off by 12pm, 10 March 2021. Based on the above, I will be staying far far away from this IPO.

Yup, agreed with your conclusion !!!

ReplyDeletequite agree not buy

ReplyDeleteThis is such a scam by the founders. Delisting market cap at 20.2m which was already a premium over then traded valuation then. Actual valuation in 2017 was probably 15m, less than the price of GCB. If no one was interested to buy it then, why are people buying in when it is valued at 1b now?

ReplyDeleteSGX really need to do see what kind of business you can do and cannot do, this is such a fraudulent IPO and yet they opened at 1.32.