Good riddance to Keppel Corp's previous offers. Cuscaden Peak (the consortium making up of Ong Beng Seng, Capitaland and Mapletree) made a superior counter offer for Singapore Press Holdings ("SPH") today. During my last post, I mentioned that Cuscaden Peak may just trump Keppel's offer of S$2.351 per share (mixture of cash and Keppel & SPH REITs in specie) by 0.1 cent only and shareholders should not be too surprised- well, it turned out to be way above expectation afterall as the current counter offer price on the table is S$2.360 per share (all cash) which is almost +1 cent more. I had enough of Keppel Corp's offers which were always a "hybrid" consideration of cash and REITs units. The market price of SPH, after every one of Keppel's offer, fell way below the fair value consideration.

Moreover, Cuscaden Peak is extremely generous and provides another option for shareholders who preferred some SPH REITs to be distributed as part of the offered consideration so that they can participate through SPH REIT units in recovery upside of the retail real estate sector while receiving a significantly higher cash component than has been offered in the Keppel Scheme.

|

| Cuscaden's offer of 2 options to SPH Shareholders are vastly superior to Keppel Scheme. |

1. Strategic mistake by Keppel Corp in their bid for SPH.

First and foremost, I think that Keppel Corp management should not have made it clear upfront that their offer of S$2.351 per share is the last and final offer. Keppel Corp may have underestimated Cuscaden Peak's deep pockets. By making a statement that they have already made a final offer, it motivated Cuscaden to just tip the bar over a little to easily trump their bid. Anyway, this is water under the bridge.

First and foremost, I think that Keppel Corp management should not have made it clear upfront that their offer of S$2.351 per share is the last and final offer. Keppel Corp may have underestimated Cuscaden Peak's deep pockets. By making a statement that they have already made a final offer, it motivated Cuscaden to just tip the bar over a little to easily trump their bid. Anyway, this is water under the bridge.

Ultimately, Keppel Corp will walk away with S$35Mil breaking fees from SPH. After paying off legal and financial advisory fees, I expect Keppel Corp to retain a substantial part of the fees for future working capital or for special distribution to shareholders. Keppel Corp share price should shoot up once the trading halt is removed. My sense is that most of Keppel Corp retail shareholders frown upon the SPH deal in the first place.

2. What does SPH senior management have to say about the current 2 offers on the table?

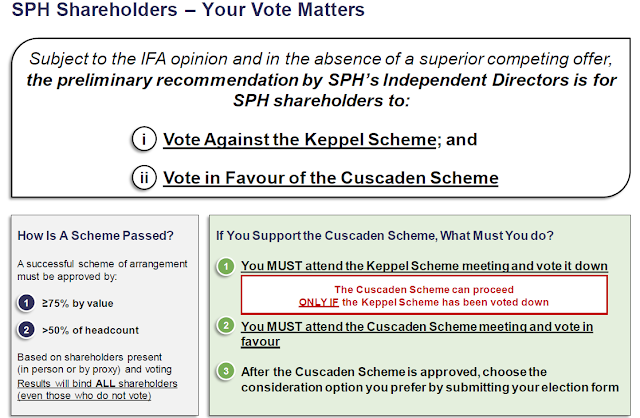

Subject to the IFA opinion and in the absence of a superior competing offer, the preliminary recommendation by the SPH Independent Directors is that SPH shareholders should vote down the Keppel Scheme and vote in FAVOUR of the Cuscaden Scheme.

|

| Vote down Keppel Scheme first and vote for Cuscaden Scheme later |

Also, SPH shareholders should take note that unlike the Keppel Scheme which is still subject to its shareholders' approval, the Cuscaden Scheme does not require the approval of Cuscaden's shareholders. All regulatory applications have been made the deal is expected to be fully completed in February 2022.

3. Other points for SPH shareholders to take note

Shareholders who need cash and want to cash out immediately should take note that the ex-dividend date for the SPH S$0.03 per share dividend is on 22 November 2021 (Monday).

So, if trading halt is removed and the price of SPH hits at least S$2.39 (S$2.36 offer + S$0.03 dividend) per share, then SPH shareholders can consider selling off.

On 22 November 2021, if the price of SPH is at least S$2.36 per share, then SPH shareholders can consider selling them off.

From 16th November 2021 to 21st November 2021, I expect the trading price to range between S$2.39 per share to S$2.43 per share. The worst case scenario would be that the price per share lingers way below S$2.36 per share but shareholders just have to hang on and wait till February 2022 for the deal completion to realize the full S$2.36 per share.

|

| SPH's investment property-Seletar Mall at Sengkang Fernvale |

Parting thoughts

I do not think that there will be a 3rd competing bidder at this stage since the price per share of SPH has seen such a huge jump over the past few weeks. With the transfer out of its Media business, SPH remaining property business has also come to a quick end. I think that shareholders should take this opportunity to cash out of SPH and let professional property management veterans take over the business. Alternatively, the only other option left is to vote down everything and let SPH continue its business under its current CEO....not exactly an ideal or rational case are my personal thoughts.

P.S: Fellow SPH shareholders, please share your views and thoughts on the Cuscaden Peak's new offer. Will you sell off immediately after trading halt is lifted to reduce further market risk or wait it out for a "counter-counter" offer albeit low probability?

Please also see my previous posts on this:

No comments:

Post a Comment