It is certainly great news that the SGX ended the last week of December 2021 with a little bang which brings much needed reprieve from the Omicron variant shock just over a month ago. The performance of Singapore REITs has so far been extremely disappointing. It has been a lagger in 2021 compared to other sectors and if 2022 is good, hopefully, we can see at least 10% increase in capital appreciation which will bring my overall investment gross portfolio to over the S$1Mil mark. Saying that, as an income focused investor, I am happy to see my projected dividend growing gradually rather than the wild fluctuation up and down in stock prices throughout the year. Mapletree has also announced the proposed merger of 2 of its REITs into a $17 billion asset new entity known as the Mapletree Pan Asia Commercial Trust.

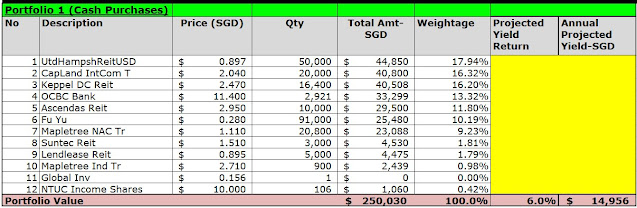

1. Portfolio 1- Stocks held in SGX Central Depository

During the past month, I have been accumulating units in Capitaland Integrated Commercial Trust ("CICT"). Its unit has dropped significantly since an all time high of S$2.35 per unit earlier this year to around S$2 per unit recently and I bought an additional 5,000 units in mid-December period.

On 27th December 2021 (Monday), I certainly regretted not buying more units of Mapletree North Asia Commercial Trust ("MNAC"). At that juncture, I was planning to add on another S$10K of investment into either MNAC or CICT. Since the price of MNAC surge suddenly (on hindsight, this seems most likely due to leakage of the upcoming corporate action), I decided to invest the additional funds into CICT instead. There is also an upcoming downside risk holding MNAC which I will probably elaborate more in another blog posting. Basically, this downside risk will also materialise in the proposed new entity but in a somewhat subdued form with the new geographical diversified property portfolio. Nevertheless, there will still be some adverse impact.

2. Portfolio 2- Margin purchased securities

I did not make any additional investments in the month of December 2021 into this portfolio. The only thing I did was to continue using my dividends received to pay down the borrowings from the margin facility.

3. Portfolio 3 (with Tiger Brokers)- Venture into higher risk as well as capital growth stocks here

No change here for the month.

Alibaba continued its downward slide. In short, terrible share price performance so far.

Dasin Retail Trust is having problem getting the bankers to continue lending it money and was on the verge of syndicated bank loans default. A trading halt was called and an announcement was made that the loan renewal is still in discussion stage due to last minute new requests by some of the lenders. However, the bankers extended the loans by another 3 months to give it some much needed breathing space.

Please see "Dasin Retail Trust On The Verge Of Bankruptcy Declaration? Will It Be Suspended From Trading on SGX?-14 Dec 2021".

Parting thoughts

The venture into my portfolio 3 for capital growth using higher risk stocks seems to be doing badly. Good thing here is that I have restricted the funds being deployed here to keep it small. The rest of the portfolio following the income investing approach is still holding up well. My StocksCafe is showing me a total of S$43K of dividends received this year (2021). Not too bad, considering the impact of COVID on low distributions declared from late 2020 to 1st half of 2021.

No comments:

Post a Comment