My net investments market value plummeted dramatically from S$613K to S$522K (a loss of S$91k) within a short span of 2 months. Gross investment before margin financing went down S$918K to S$795K (a decline of S$123K). I still vividly recalled being made "famous" by some retail investors during the March 2020 COVID crisis (whereby I faced an even worst decline) when my blog was published by those individuals on Hardware Zone forum as a good lesson to all on the danger of using margin financing despite them not knowing anything about my overall financial position and contingency plan in place. In addition, as an income focused investor, I am more concerned with the resiliency of dividend/distributions in my portfolios during bear market rather than the market value. I only have this to say about the use of margin financing: if one does not have any strategy, self-discipline or contingency plans in terms of managing leverage in different scenarios, then it is best to stay far away from it.

Anyway, the various global stock markets performance have been going up and down as if they are playing a game of Yoyo. The last 2 weeks has been extraordinary volatile with ferocious & rapid sell off in SREITs to 52 weeks record low- I was simply stunned by the brutalities of investors who kept dumping their units as if there is no tomorrow. For this round of market turmoil, I am glad that my SREIT holdings such as Capitaland Integrated Commercial Trust and Keppel DC REIT continued to report good results despite the great fear instilled by the relentless increase in borrowing rates. In spite of the volatility, I have continued investing during this dark period and also make some minor changes to my portfolio which I should elaborate further below.

1. Portfolio 1- Stocks held in SGX Central Depository

(Note: This portfolio is designed to provide immediate dividends for use (if required) as it is under my own CDP account and the dividends credited goes directly to my bank account.)

(i) I have purchased Digicore REIT. Personally, I find that its price has fallen till a very ridiculous level with distribution yield of over 6.5%.

2. Portfolio 2- Margin purchased securities

(Note: My margin purchased securities has grown to a sufficient scale to sustain itself and also to repay annual financing charges as well as to gradually pay down the margin loan through dividends generated.)

I have taken profits by selling down the bulk of my banking stocks OCBC and UOB (while retaining some small stakes in my margin portfolio) and reducing my margin borrowing by S$31K (from S$304K to S$273K). While it is true that rising interest rate does benefit banks but the problem here is that if a severe recession with numerous job losses (we already seen the radical 900,000 job retrenchment exercise being announced by Credit Suisse), default of banks loans as well as decrease in loans granted will mean worsening results for the bankers. I decided not to take the risk and to lock into the profits.

In addition, I have made further investments into Capitaland China Trust and also AIMS APAC REIT.

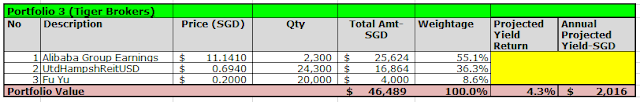

3. Portfolio 3 (with Tiger Brokers)- Venture into higher risk as well as capital growth stocks hereMain updates here:

(iii) I have also ventured into investments into S&P 500 initially here but have since sold it off to raise the level of cash to wait for good opportunities during this market turmoil.

Summary

Given the recent good results announced by the various SREITs (except for US office REITs), I expect dividends to continue rolling in over the next few months.

No comments:

Post a Comment