Recently, my insurance agent (her name is "Aura") arranged an appointment with me to introduce a highly innovative investment product from AIA. Ms Aura further mentioned that AIA is now working with Blackrock to manage their assets. She told me that for a yearly sum of S$12,000 (payable for 10 years), the AIA Pro Achiever product gives very high return of 15% bonus for the 1st year, 18% bonus for the 2nd year and 20% bonus for the 3rd year which is a whopping cumulative 53% bonus!

Well, it certainly gives me the false impression that one is given a stellar S$3,960 of investment return (+16.5% return) out of S$24K of capital being invested into this innovative product within 24 months of investing S$24K in pre-paid premiums. At the same time, 100% of the premiums paid are being converted into Investment Link Product ("ILP") units according to my agent. So it appears that AIA is doing charity work?

There is no free lunch and "out of the world" investment return from insurance companies

Taking into account the many mouths to feed in AIA, its fund manager as well as the commission for the insurance agent herself, everyone will know that this product does not make sense if it is giving out freebie and cannot be behaving like a normal unit-trust. Investment Linked Products from insurance companies are still murkier than mud with a total lack of transparency and worst still, as hard to comprehend as ever on the strange technical terms that their agents use to muddle their prospective victims customers.

The marketing gimmicks embedded here is that the impressive returns are actually "bonus" as well as the myriad of well-concealed charges to claw back the "bonus". For those who en-cashed their whole-life insurance bonus before will know that it is not a S$1 to S$1 basis when insurance bonus gets converted to cash equivalent. So I seriously do not understand why insurance agent like Aura keeps hammering on this super-size bonus award as their key selling point for an investment product. I thought the key selling point should be the type of investible funds but alas for me, a whole half an hour was spent by Ms Aura talking about the 53% out-sized bonus instead.

For those still interested, I list down the key points of this "innovative" product and you can contact your own AIA insurance agent over this irresistible product:

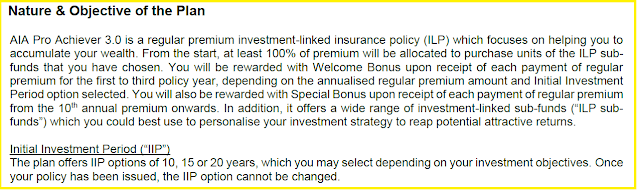

1. What is this AIA Pro Achiever that brings in such stellar return for investor?

2. High "Bonus Return" from this product

3. 100% of your premiums used to buy into units immediately? So free sales charges-so awesome wor!

Parting thoughts:

There are sales charges and other yearly fund management charges that one needs to clarify in detail over this "innovative" ILP product. 100% premiums invested upfront into units does not mean that the insurance company cannot sell the units subsequently to pay for the above mentioned charges plus the "special bonus". Last but not least, do your own due diligence. Don't get smoked by your own insurance agent and then ended up buying something that you will regret later on. Have a great week ahead folks!

Bro you are so kind and patient with the agent

ReplyDeleteHi Bro Henry, sometimes good to sit down and listen to new product talks. The traditional ILPs I recalled deduct 10%-15% off the yearly premiums for 3 years and only invest the remaining into their funds-my first investments were in NTUC Income ILP recommended by my then agent.

ReplyDeleteSo it is interesting to hear about the new way insurance company repackage their ILP products for it to be more appealing to new customers. The "100% of premiums go directly into purchase of units" is a very powerful marketing tool for new generation ILP that sought to try convince customers that insurance ILPs are even better than direct investing into unit trusts.