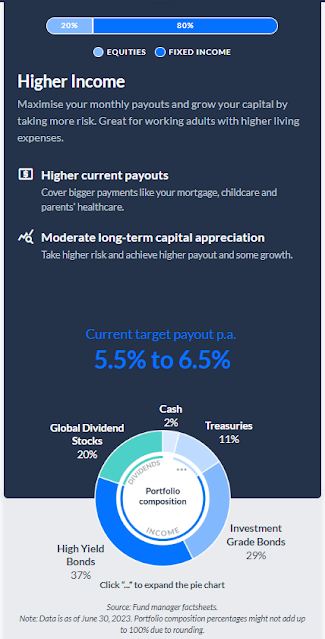

In view of the higher interest rate environment, bonds have been giving out attractive high yields relative to the past few years. I have thus been putting more than half of my recent extra cash on hand into the Endowus curated Passive Income Portfolio. This is a 20%-80% portfolio split (into equity and bonds respectively) that aims to provide passive income of 5.5% to 6.5% distribution per annum. The strange thing is that Endowus Hong Kong has another deployed solution that pays a higher 6.5% to 7.5% using a 100% bond strategy.

|

| Singapore Passive Income Plus |

|

| Endowus Hong Kong Passive Income-Plus |

Anyway, I will be dropping a note to Endowus Singapore to check with them on the enigmatic differences in configuration of Income Portfolios for Singapore and Hong Kong when both are under the Endowus branding. Good thing about bond fund is that they provided sufficient diversification for one to invest in risky high yield debts.

Updates on 15 Nov 2023- Response from Endowus Client Advisor on the differences:

<QUOTE>

Thank you for reaching out to us.

(1) To share, the portfolios are designed differently as the audiences/investor markets in Singapore and Hong Kong are quite different. Additionally, the fund offerings (investible universe and currency denominations) between the two countries differ as well.

(2) One more thing to note would be that in Singapore, the advised portfolios are pre-set and thus any investors in the portfolio would be subscribing to that exact allocation; on the other hand, in Hong Kong, the Passive Income Portfolios are model/template portfolios that client may refer to and modify.

</QUOTE>

No comments:

Post a Comment