United Hampshire US REIT ("UHREIT") has been badly bruised for the past year. From its 52 week high of US$0.535 per unit to the recent US$0.380 per unit as at 9 November 2023, this is an extremely worrisome and disappointing plunge of <-29%> . This translates into an absurdly high 14.8% distribution yield and an insanely low Price to Book Ratio of almost 0.5 times. UHREIT is thus currently providing a +10% yield above the 10 year US Treasury rate of 4.6%.

1. Stable results and continued good news from Q3 Ops Updates

Gross revenue and Net Property Income for the 9mth of 2023 has increased 11.7% and 12.2% year on year respectively. UHREIT also continued to maintain its high committed occupancy of 97.2%. This is a far cry from other US Commercial REIT such as Manulife US REIT, Keppel Pacific Oak and Prime US REIT.

The best news from this update is that the Academy Sports Building in Port St.Lucie has been completed way ahead of schedule (originally, I thought that this extension building will only complete in mid 2024). The new 63,000 sqft store opening is projected to commence by end of November 2023 which will mean that a new stream of rental income for the full month of December 2023.

2. Attractive high yield and price to book ratio.

This one really OMG- price crashed till so low and distribution yield now expanded to approximately 14.8%. Maybe many investors staying away from UHREIT due to its 40% plus leverage ratio which is not ideal considering year end revaluation of all properties required by IFR. The other possibility is the sad fate of the US Commercial Office REITs leads to fear of breaching the current banking covenants and distribution suspension akin to Manulife US REIT.

3. How is UHREIT different from other US commercial properties?

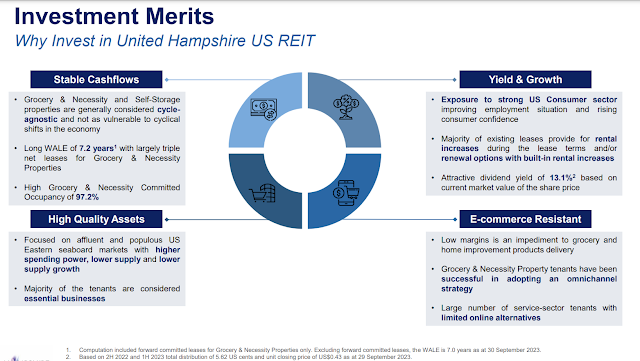

The above points depicts the unique nature of UHREIT business whereby its tenants are considered economic cycle agnostic and recession resistant. This also explains why its physical occupancy rate of properties is always so high throughout the past 3 years since its IPO.

4. The hidden dark side of UHREIT and risks of holding on to it

By the way, UHREIT is not entirely an angel and there are some grave risks that even their CEO does not want to address directly:

1. Leverage ratio of 40% plus is a tad too high albeit the recession resistant storyline. In extreme scenario, it will end up similar to the fate of Manulife US REIT once an unforeseen event lead to a breach in its banking covenants and the disastrous chain effect or death spiral might result. The leverage ratio is simply too high for comfort.

2. Change of US tax rule and imposition of withholding tax. The requirements on the current tax planning structure crafted out can change overnight. This already happened a few years back before where US Office REITs valuation plunged due to the then concern over newly announced tax rule interpretation.

3. Forex risk as the operations are all in USD. If USD were to further weaken, Singaporean investors will see their investment value being eroded eventually.

4. In event that UHREIT needs financial support, equity fund raising via rights issuance will be virtually impossible for a US SREIT due to the group tax structure in place which is closely tied to the 9.8% restriction in ownership. Any change in the trust structure is highly complex which requires tax professional re-design and also US Tax authorities clearance. Manulife US REIT has led the pack in examining this challenge which it has not been able to resolve even till this date. So, no matter how financially strong are the sponsors, the 9.8% restriction in individual entity/individual shareholding is an unbreakable curse that renders the backstop of equity fund raising exercise by the sponsors as good as useless.

Parting thoughts

Personally, I have been adding some minor stakes into UHREIT in view of the sudden plunge of unit pricing to below US$0.40 per unit as I think it is very undervalued. Nevertheless, I will not be able to add on additional significant stakes into UHREIT as that will further over-concentrate my already large exposure to UHREIT. The economic cycle agnostic and recession resistant storyline marketed by UHREIT is certainly compelling from its historical performance. The problem with investment is that one can never know what they don't know. Diversification is still the only way to prevent one's carefully built up investment portfolios from sinking into oblivion.

Added more recently as well!

ReplyDeleteHi Happy RI! Good to hear from you….trust all’s well at your side. Powell literally just destroyed the recent mini-SREIT rally with his remarks that he wants another rate hike to reach his 2% inflation target. :)

DeleteHey BK, just want to encourage you. I've been following your analysis on UH reit. The logic is sound.

ReplyDeleteOf the 4 risk you highlighted, Gearing ratio is significant. The others are just rules that every reit faces.

This gearing ratio risk is similar to Landlease Reit.

You don't know what you don't know so don't fret over it.

Hi damn, thanks for the encouragement and dropping by...much appreciated! I am keeping my fingers crossed that no major surprise for year end results released early next year for UHREIT. :)

DeleteAgree on the stakes part. I will only allocate 6k (SGD) to this and keppel pacific oak each, based on my risk appetite.

ReplyDeleteSo far have only sunk 2k sgd into this and 0 into keppel pacific oak. Plan to do so when i have the funds.